Portland Paints and Products Nigeria(PPPN) Plc has explained why they did not declare dividends for the financial year ended December 2014.

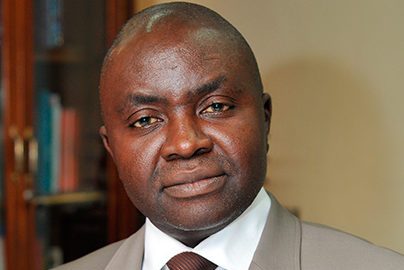

Addressing the shareholders at the annual general meeting(AGM) in Lagos on Tuesday, the Chairman of PPPNP, Mr Larry Ettah, said despite the higher profit, no dividend would be paid due to strategic reasons.

“For strategic reasons, the board is not recommending the payment of dividend for the year ended 31st December, 2014 but hoped that with the company’s improved performance, this may not be a challenge anymore.”

According to him, the company was being repositioned for better future performance. This repositioning, he added, would require capital raising.

“We are realigning our portfolio and making strategic shifts where necessary. We will continue to focus on innovation and seek opportunities to introduce new offerings into our portfolio of brands as well as build capacity in our people. In pursuit of plans to improve returns and address the high leverage position of the company and our other business expansion plans, the Board has recommended for your approval a capital raise by way of Rights Issue. The board will therefore be glad to have your kind approval,” Ettah said.

Portland Paints closed trading at N3.47 on Tuesday and as lost about 11% in value this year.