The Nigerian All Share Index closed the week lower losing 0.49% to close at 34,272.09. The market capitalisation also closed lower losing 0.45% to close at N11.644 trillion. Despite these losses two stocks topped the gainers chart for the week with each gaining 29% respectively. We examine why this happened.

Vono Products

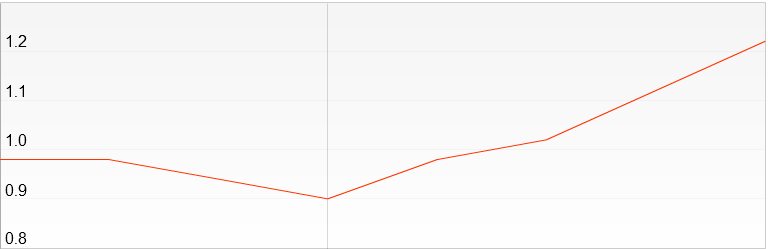

The stock ended up with a 29.8% gain after it opened the week at 94 kobo and closed at N1.22. Volume for the stock was however thin with just about a million units traded during the week. In fact, the highest volume traded was on Monday with about 592, 780 units.

The reason for the bullish rally was mostly due to the announcement of a merger deal with its Parent shareholder Vitafoam Plc. Even though details of the deal were yet to be announced, the market took the news positively.

Be wary of the stocks liquidity should you want to buy it as your broker might not see enough units to buy.

NEM Insurance

NEM Insurance also joined the gainers chart at the top after it gained about 29.4% last week. It opened at 68 kobo and closed at 88 kobo per share. Unlike Vono Foam over 40 million units of NEM shares traded hands during the week.

NEM rally was also about the company’s results and dividends proposed during the week. NEM declared dividend of 6 kobo per share which at the start of the week implies a dividend yield of under 8.8% at the start of the week. The company also followed that up with a strong Q1 results (see our analysis of NEM). Ironically, NEM has now gained much more than the dividend yield it offered investors at the start of the week.

Investors looking to buy should be wary of a bull trap as most investors are perhaps buying the stock to reap profits. Know when to time your entry and exit if you are a short term investor.