PMS price cut and volume slowdown weigh on top-line

- Mobil Oil Nigeria Plc “Mobil” Q1 15 reported 26.4% YoY contraction in revenues to N16.5billion—the lowest in 15 quarters. Whilst we had expected a drop in topline (-19% YoY) due to relatively high base in Q1 14and 10% reduction in PMS retail prices to N87/litre in early 2015, the wider contraction suggests Mobil cut volumes to minimize exposure to gasoline subsidy, likely in response to the price reduction.

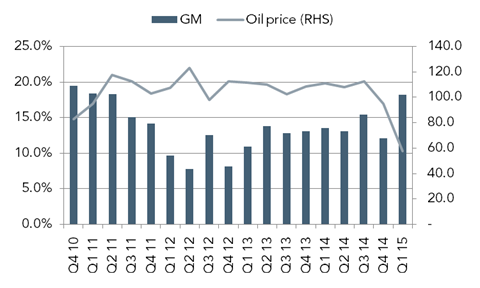

Benign crude oil price buoys gross margins

- Tracking revenues, input costs fell a quicker 30% YoY to N13.5 billion (13% below our estimate) paringgross profit declines to a modest 1.4% YoY (+31% QoQ) to N3.0billion. Accordingly, gross margins expanded (+460bps YoY) to the highest in 16 quarters (18.1% vs. Q1 15E: 14.3%). Importantly, whilst we had anticipated GM expansion, largely on the heels of softer oil prices, the wide expansion, which was also buoyed by sharper than expected drop in thinner margin gasoline throughput, suggests contribution from deregulated products like AGO and lubes were higher than we anticipated.

Figure 1: Mobil quarterly gross margins and Brent crude oil price ($/bbl)

Source: Bloomberg, ARM Research

Surge in other operating income magnify GM gains and buoy profroma earnings

- Mobil’s operating expenses rose 15.3% YoY to N2.0 billion, which is only 2% lower than Q4 14 level. Available results do not provide a breakdown, but given sharp declines in topline, we believe the increase was underpinned by higher administrative expenses, likely driven by depreciation charge on company’s investment property after huge net investment in excess of N6 billion over 2014. Thus Mobil’s earnings from core operations fell ~24% YoY to N915 million, short of our estimate by a similar margin. Nevertheless, a sharp (+73% YoY) increase in other operating income to N1.1 billion (Q1 15E: N639 million) reversed declines, with Q1 15 operating income of N2.1 billion (+7% YoY) running 50% ahead of our estimate. Accordingly, operating margins expanded 4.0pts YoY to a record 12.5%, relative to our 7.5% estimate.

- Net finance income fell 85% YoY to N7.2billionand with no asset sale in the period—relative to N2.8 billion gain on sale in Q1 14—PBT and PAT were 56% and 62% lower at N2.1 billion and N1.5 billion, respectively. However, excluding this one-off item, PBT is 5.5% higher YoY, though higher effective taxes of 32% (vs. 19% in Q1 14) drove proforma PAT 7% lower. Relative to our estimates proforma PBT and PAT are 54% and 63% higher stemming from the combination of softer input cost and jump in other income. Mobil’s proforma PBT and PAT margins expanded 3.8pps and 1.9pp to 12.5% and 9%, respectively compared to our 7.4% and 5.1% estimates.

Share price still richly valued by our estimates

- Broadly speakingour expectations for 2015, delineated in our Q4 14 update, remains largely unchanged. Specifically, we noted that soft input costs for deregulated products, particularly lubricants and AGO—due to low oil prices—increase scope for margin expansion. This theme appears to be panned out with thisQ1 15 result and should be sustained over the rest of 2015 barring a sharp recovery in oil price. On the latter, while oil prices have rallied nearly 18% over April 2015 to $65/bbl on geopolitical risk and continuous drop in US rig counts, the fundamental oil glut story remains largely intact, even as US inventory levels continue to climb to record highs. Thus we believe that oil prices are unlikely to return to 2014 highs over the near-term. That said, marked deviation of Mobil Q1 15 performance from our estimates, particularly in relation to input cost, leads us to revise some of our less sanguine position to better reflect the pass through from soft oil prices from Mobil’s deregulated products. Consequently, amidst modest downward adjustment to our 2015 revenue expectation—on the back of fuel shortages over second quarter—we now expect 2015 GM margin of 16.7% (relative 14.4% previously), with our GM over our forecast horizon (2015E – 2019E) now 120bps higher. Adjusting our 2015E operating expenses higher (+4.4% YoY to N7.6 billion)—to capture increased depreciation expenses—while leaving other estimates largely unchanged, we now expect 2015E PAT of N4.6 billion (+19% from previous). Net effect of these alterations drive our FVE 13% higher from prior to N111.37, but market price remains at a 34% premium. Furthermore, Mobil trades 3.6x current book value and 11.4x 2015E earnings, both at premium to peer averages of 1.5x and 8.2x respectively. We retain our SELL rating on Mobil.

- Source: ARM

Disclosure – This article was culled from ARM Research newsletter and was not solely written for Nairametrics. The author of this article wrote it themselves, and did not write this article on behalf of Nairametrics.