Nestle Nigeria Plc (3 months ended March 2015)

Revenue plunge headlines a weak performance

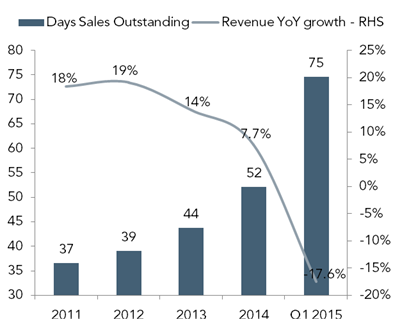

- Nestlé Nigeria Plc (Nestlé) released unaudited results for 3 months ending 31st March 2015 wherein revenues declined 17.6% YoY to a 13-quarter low of N27.6 billion. (Q1 15E: N34.4 billion). Amid stable pricing, 49% jump in receivable days to 75days suggests underlying weakness with revenues across both segments.

Figure 1: Day Sales outstanding and Revenue growth

Devaluation shock to interest expense hurts earnings

- Tracking revenue declines, COGS fell by a similar magnitude (-17.2% YoY to N15.4billion) leaving margins largely unchanged at 44.2%. (Gross profits: -28% YoY to N12.2billion). In contrast to coverage consumer names, Nestlé’s higher local sourcing of raw materials helped shield margins from impact of USDNGN weakness.

- In a similar manner, S&D costs declined 17% YoY to N4.7 billion. The trend did not however extend to administrative expenses which jumped 25% higher YoY to N1.9 billion, offsetting the decline in S&D costs and resulting in a 8.4% YoY decline in opex to N6.5 billion. By implications, opex to sales increased YoY to 23.7% (21.4% in the corresponding period of 2014). Consequently EBIT stood 26.9% lower YoY at N5.6 billion.

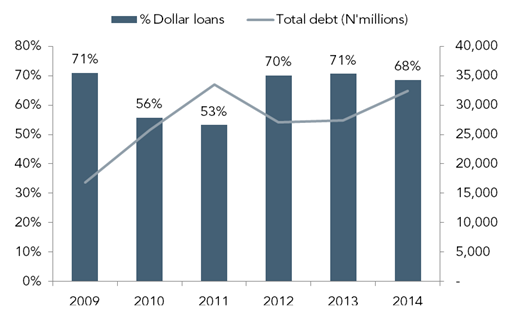

- Reminiscent of Q4 14 when naira weakness (-8%) drove a spike in interest costs, Q1 15 net finance expense rose three-fold YoY to N2.2 billion largely reflecting wider devaluation in February (-17%) on Nestlé’s dollar debt (65% of total borrowings). Largely reflecting top-line weakness and shocks to interest expense both PBT and PAT contracted 51% YoY to N3.5 billion and N3 billion respectively with corresponding margins shrinking 8.5pps and 7.2pps YoY to 12.7% and 10.7% respectively.

Figure 2: Nestle’s Debt

Source: Nestle Financials, ARM Research

SELL recommendation to persist

- The sharp pullback in sales should result in downward review to our expectations over the rest of 2015 though we will engage Nestlé’s management for clarification drivers. Focus now shifts to interest expense line which we expect to provide a source of earnings weakness over the rest of FY 15 as we do not expect Nestlé’s exposure to high levels of foreign debt to change dramatically. Nestle trades at a current PE of 39.25x compared to Bloomberg peers at 24.5x, with a last trading price at 36% premium to our fair value estimate (N607.4). We maintain a SELLrating on the stock.

- Source: ARMDisclosure – This article was culled from ARM Research newsletter and was not solely written for Nairametrics. The author of this article wrote it themselves, and did not write this article on behalf of Nairametrics.