Dangote Sugar Refinery Plc. (12 months ended December 2014)

- Dangote Sugar Refinery Plc (DSR) released audited results for 12 months ending 31st December 2014 wherein revenues declined 8% YoY to N94.9 billion. PBT fell 6.1% YoY to N15.3 billion while PAT rose 7.3% YoY to N11.6 billion.

- DSR also announced a 40 kobo dividend per share which implies a payout ratio of 42.8% (FY 13: 66.4%) and a yield of 5.5% using its last trading price.

Volume weakness underpins sales contraction

- Revenues extended the pattern of negative growth over 2014, contracting 17.3% YoY to N21.1billion over Q4 14. (Q4 14E: N26.1 billion). This is in line with management’s guidance of a challenging quarter given the impact of gas disruptions and increased reliance on alternative fuel on production. The energy challenges possibly weighed on volumes sales as refined sugar prices were higher over Q4 14. Over the year, revenues decline reflect both volume pressures and price decline (5% YoY).

USDNGN devaluation induces operating loss

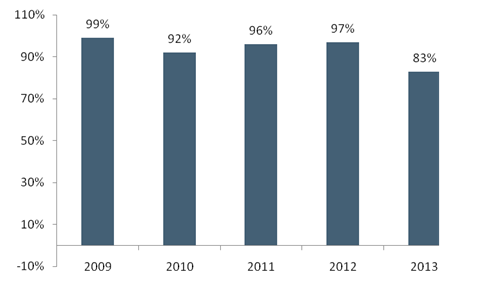

- In contrast with the steep declines in revenue, Q4 14 COGS was flat (+0.3% YoY to N19.2 billion) resulting in gross profits plummeting 70.9% YoY to N1.8billion. Whilst mean raw sugar prices were 11% lower YoY over Q4 14, the flat trend in COGS suggests a similar dynamic as with coverage basic food producers where USDNGN devaluation during the period (-8%) neutered benefits from benign input costs. The offsetting impact stems from DSR’s high imported raw materials-COGS ratio (FY13: 83%) which leaves the company more exposed to naira weakness on imported raw sugar inputs. Consequently, gross margins plunged 16pps YoY to 8.7%. The weaker Q4 14 gross profits weighed on FY 14 reading (-24% YoY to N18.6billion) and resulted in a 4.2pps YoY contraction in FY 14 gross margins to 19.6%.

Figure 1: Imported raw materials-COGS ratio

Source: DSR Financials, ARM Research

- Additional cost pressures emanated from operating expenses which declined slower than revenues (-1.7% YoY toN5.47 billion), underpinned by deferral of management’s expense from Q3 to Q4 14 which pushed opex-sales ratio4.1pps YoY to a multi-year high of 26%. Thus reflecting naira weakness and opex pressures, DSR reported operating loss of N3.6 billion vs. an operating profits of N726 million in Q4 13.

Nonetheless, tax credit drives positive earnings growth

- Net finance income more than doubled YoY to N5.3billion reflecting the gains of similar magnitude in finance income. Assisted by an 81% YoY contraction in other losses, the higher finance income swung DSR from an operating loss to a pre-tax profit of N2.5billion (-1.1% YoY) with related margin 1pps lower YoY at 6.2%. Furthermore, a N1.2 billion tax write back resulted in PAT more than doubling YoY to N2.5 billion (PAT margin: +7pps YoY to 11.8%).

Naira weakness and higher discount rate sees FVE lower

- Further USDNGN devaluation by CBN in February through the collapse RDAS to the inter-bank market should induce input costs pressures. Whilst higher input costs suggest price increases, we believe DSR would be unable to fully pass-through the higher costs to consumers which sees scope for gross margin compression. Incorporating the foregoing into our models and adjusting our discount rate to capture recent rise in sovereign yields results in a moderation in our FVE estimate to N6.77. DSR trades at current P/E of 7.45x vs. 11.59x for Bloomberg regional peers with last trading price at a 7% premium to our FVE which translates to a SELL rating.

- Source ARM

Disclosure – This article was culled from ARM Research newsletter and was not solely written for Nairametrics. The author of this article wrote it themselves, and did not write this article on behalf of Nairametrics. However, Nairametrics owns shares in Dangote Sugar Plc and does not plan to buy shares in Dangote Sugar Plc in the next one week.