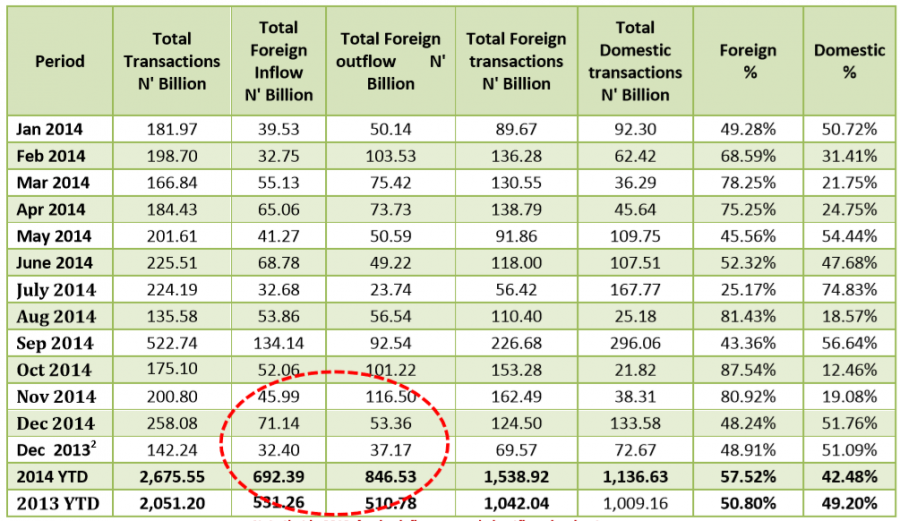

The Nigerian Stock Exchange released its 2014 Domestic and Foreign Portfolio Participation in Equity trading showing a total of N2.675trillion worth of transactions passed through the exchange in inflows and outflows. The breakdown shows foreign Inflows was a total of N692.3billion whilst a total of N846.5billion was outflows. Total Outflows exceeded 2013 total of N510.78billion by a whopping 65%. However, 2014 inflow exceeded 2013 inflow of N532.2billion by 30%. Net Foreign Outflows for 2014 was N154.2billion compared to a Net Foreign Inflow of N21billion for 2013.

In 2013, foreign inflows exceeded outflows by about 4%. In 2014, foreign outflows exceeded inflows by 22%. Domestic transactions totaled N1.136trillion a 12.5% increase from the N1 trillion recorded in 2013. Total Foreign Transactions of N1.5trillion represents 57.5% of total transactions compared to 42.2% for Domestic Transactions of N1.136trillion. It was 50.8% to 49.2% in 2013.

Get report here

![[The Nigerian Economy Daily] FG has approved the closure of five foreign missions and embassies](https://nairametrics.com/wp-content/uploads/2017/05/nigerian-economy-today-1.jpg)