Source: Bloomberg

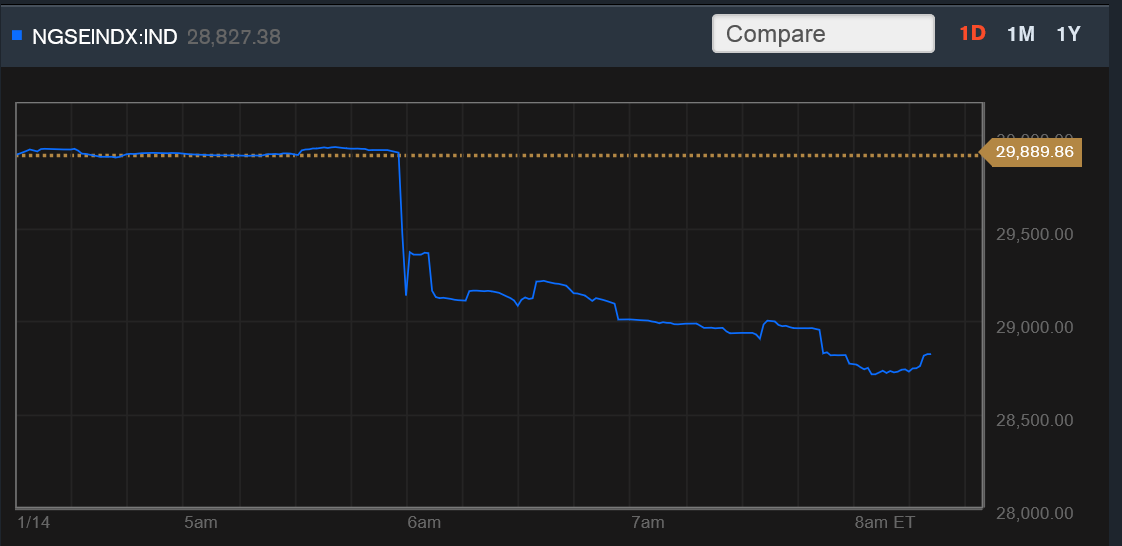

Nigerian All Share Index already has the enviable record of being the worst performing stock of 2015 after it has dipped by over 13% before beginning of trading Wednesday. So when the market opened, no one expected a reversal of the bearish trend as this is gradually becoming the norm. And so stocks traded marginally lower until this happened.

Oscar Onyema gave a speech today recapping the performance of the stock exchange for 2014 and its outlook for 2015. According to Bloomberg which tracked the speech, the CEO of the NSE was quoted as saying the NSE was no longer looking at hitting the $1trillion target it set for it self. Here is how Bloomberg reported it

The Nigeria Stock Exchange said its target to reach a $1 trillion market capitalization by 2016 was scuppered by the world’s biggest equities decline this year.

The objective is no longer possible because of the “current realities” facing the bourse, Chief Executive Officer Oscar Onyema told reporters in Lagos, the commercial capital, today. “Challenges to the naira, the fall in oil price and uncertainties due to an election year has caused a selloff in the market.”

The NSE also published its 2014 year-end recap and outlook which also included the following excerpts

Nigeria’s 2015 macroeconomic performance is expected to be influenced by a number of variables, including crude oil prices, foreign exchange movements, national security, global financial markets, fiscal and monetary policies, as well as the outcome of the 2015 elections. Post elections, we anticipate that elimination of some of the uncertainties highlighted earlier may lead to stability in the equities market. However a strengthening dollar may continue to precipitate FPI reversal, which remains a real threat to the Nigerian capital market.

Although economic growth projections for 2015 will be greatly impacted by the challenges above, we expect that as time progresses, and as uncertainty is steadily reduced across all of the risk categories, that negative sentiments in the market will begin to subside, with volatility slowing in the second half of the year, strengthening potential for a market rebound.

Reports reaching us suggest the market reacted negatively immediately after this and what was to follow was a mage sell-off with large cap stocks leading the way. The reactions sparked off a new round of sell-offs that sent stocks hitting new year lows and sending the index to a new two-year low of 28,760.61. Even the November and December crash never got this low.

The question on the minds of most analysts now is that could this have been the worst possible time to release this sort of statements considering market sentiments and the market volatility that persist? Has he basically eroded investor confidence at least in the short-term. However, you look at this, it has certainly not helped the market in spite of his noble intentions. The Nigerian All Share Index has now lost 17% year to date and is now the world worst performing stock this year according to Bloomberg data. The index would also close with only 8 stocks gaining and 36 losing. These are the top gainers and losers today.

How can the nse achieve a1 trillion can be achieved in this only way (1)increases the numbers of listed company at least 10,000 company,which will push the markets 92) if the naira appreciates vs the dollar or the power,which is easy,if they have the political will,and they create foreign currencies exchange,and so fort