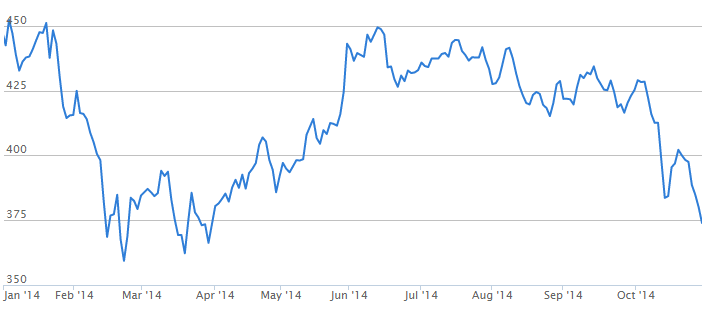

The uncertainty surrounding Nigeria’s political future is undoubtedly causing a delay in the execution of corporate strategy, as foreign investment decisions await the outcome of key government events.

With the presidential elections coming next year, there are fears by international investors that Nigeria’s fragile democracy could come under stress, resulting in more volatility in the business and economic climate.

A significant amount of financial resources will be expended on conducting the elections, but costs could spiral out of control depending on the gravity of events post-election. Asides the fact the post-electoral turmoil is a possibility, there are also concerns that the elections will strain the reserves of the country, leaving the CBN with reduced arsenal. Already, accretion into the reserves has suffered from falling oil output on the back of oil infrastructure vandalism and theft. With the recent drop in prices, the impact on reserve build-up could set in, though a price rise could soon counter the effect.

In a different vein, the uncertainty surrounding global oil price levels means that oil and gas firms will slow down the pace of their capital expenditure, as Exploration and Production firms evaluate the viability of new investments.

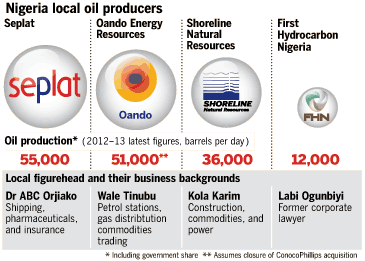

The lethargy characterizing international investments has presented quite an opportunity for local players and investors that seem to “know their terrain better”.

As international investment decision makers stand at the by-lines in speculation, local players could nimbly make strategic moves to set themselves up for the future when such opportunities will then come at a higher premiums.

Opportunities in the oil and gas sector for local investors have come from:

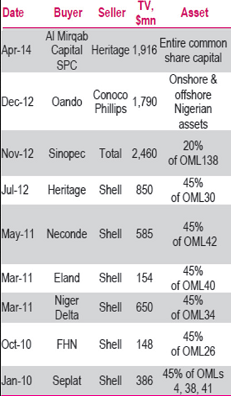

- Marginal oil field assets which are being shed off by IOCs. International Oil Companies most notably Shell divested from marginal fields in Nigeria following a change in its broader cost-cutting strategy. Shell has preferred to focus instead on its off-shore operations because producing on the deep-sea is ‘less dramatic’ since it won’t have to deal anymore with local communities.

- The availability of a local market to snap up oil assets has provided a better incentive for IOCs to sell their higher-cost assets.

- With the 2019 license renewal date approaching, non-priority assets could be further sold. A mining licence renewal will require a more detailed plan for deeper investments and developments. This ‘hassle’ will mean that IOCs will seriously evaluate their current onshore operations and shed assets that don’t meet the specified return threshold.

- Generally, IOCs consider deep-sea and offshore as being the best options for growth in Nigeria, hence onshore assets are considered lower priority.

- Companies’ delay in awaiting the outcome of the 2015 presidential elections

“Most exploration is at a standstill because investors don’t know what will happen after next year’s election. Once the election is over and stability resumes, oil activity will kick in again,” head of environment, health & safety Gogomary Oyet at Oando Plc said at the Africa Oil & Gas Summit in Sandton. Oando, listed in Nigeria and Johannesburg, is an indigenous Nigerian company.

- The delay in the PIB, which is holding off significant foreign investment.

A significant part of exploration activity is on hold, as investors are unsure of what the oil and gas terrain will be like. Meanwhile, deep changes in the tax climate will be expected. Taxation is expected to be modelled after output such that the more a firm produces, the more tax it pays.

The government however is keen to encourage local content and new investments, but the delay doesn’t sit well with international investors.

The entrant of the local companies replacing IOCs could see the oil production landscape in Nigeria take a turn for the better, as indigenous companies are seen better able to handle community-related production-disruptions than the IOCs. Oando, which deployed two rigs in the Niger Delta, has experienced no downtime because of how it manages its community relations.

“We believe this trend will lead to the emergence of five to seven local companies that will be able to produce 50000 to 100000 barrels of oil a day within the next few years.”

How Nigeria handles the coming elections, and how the results will bed into the society will be seen as a pointer to the longer term political stability of the country.

Stability after next year’s elections will be a good sign that Nigeria is ready to move to the next stage of becoming the prime business location in Africa, and will accelerate investments into the country.