Summary

- The recent foreign investor rave for ETI is justified, but the lack of a clear-cut strategy for the Nigerian market means that its upside is limited

- Its strategy for growth within Nigeria will be very key to the future growth potential of the entire group.

- There is a lack of a focused and peculiar growth strategy to play the Nigerian market.

Last week, ETI notified the NSE of Nedbank Group’s acquisition of a 20 percent ETI stake. The $493.4 billion deal will see ETI repay its $285 million debt to Nedbank which was used in ETI’s expansion drive into the Nigerian market via the acquisition of Oceanic Bank. In line with former arrangements, board seats will be swapped between the two entities. This comes after QNB’s quick-fire acquisition of a 23 percent ETI stake.

ETI as an investment has had different appeals, depending on the investor’s perspective, and location perhaps. For foreign investors looking to play the African growth story, ETI is a no-brainer. ETI’s most appealing selling point is its unique pan-African footprint. An investment in ETI gives the investor an instant exposure to 33 African countries in one go. QNB and Nedbank, both looking to offset diminishing margins in their home countries by tapping into higher growth opportunities across the African continent, hoped to ride on the pan-African platform already provided by ETI. Undoubtedly both moves were strategic.

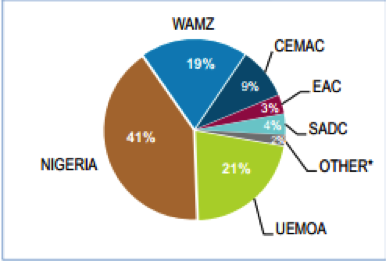

Some investors within Nigeria however, have differing opinions about the viability of ETI as an object of investment. As a market, Nigeria accounts for more than 40 percent of both ETI’s total revenues and customer deposits. This share is set to increase even further. With this block of revenue and deposits coming from the Nigerian market, its strategy for growth within Nigeria will be very key to the future growth potential of the entire group.

Source: Afrinvest Research

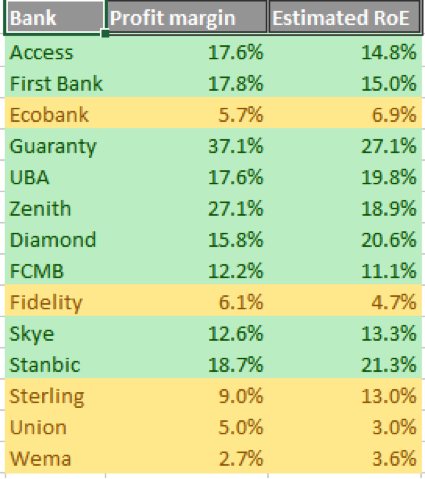

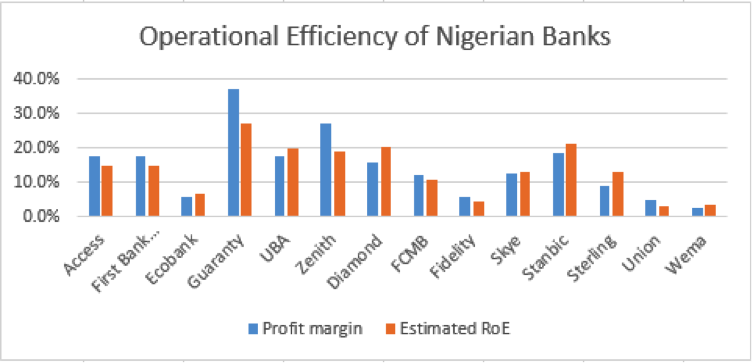

For Nigeria-centric investors, a number of issues have been pointed out as being potentially limiting for ETI’s upside trajectory. One is the lack of a focused and peculiar growth strategy to play the Nigerian market. According to Afrinvest research, ETI’s deposit-base growth rate of 13 percent Y-o-Y (FY 2013) is well below the Tier 1 average deposit growth rate of 18.4 percent, and the industry-wide average of 18.2 percent. Its domestic banking share (which covers retail, SME, local corporate and public sector) of total deposits fell to 64 percent from 69 percent in FY 2012. Retail banking penetration, especially targeted towards the young population, has been highlighted by analysts as a potent growth strategy. “When you look 10 to 15 years down the line, a bank like GT bank, which has great appeal to the young population, will continue to lead the industry” says a global financial markets trader who pleaded anonymity.

The author, Edo Ifebi is an analyst with Businessday Nigeria