Zenith Bank released its 2014 half year results showing an 8% rise in earnings per share. The results looks good on paper and is sure to please a large number of shareholders. Whether it will help push the share price higher than the 41% it has returned in the last one year will depend on a number of qualitative and quantitative factors. For banks going through a tough period it is critical to take a close look at their Net Interest Margins, Income from Commission, Fees and other sources as well as their operating expenses (cost to income ratio). These have a bearing on what is share price will do.

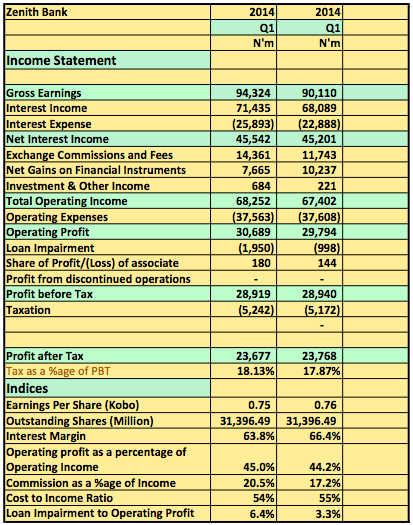

Net Interest Income: Even though, Interest Income rose 8.7% interest expenses rose 32%, resulting is a sharp drop in Net Interest income when compared to the same period in 2013. Net Interest Income for Zenith Bank averaged N47billion the whole of 2013 with the lowest N45.6billion coming in the first quarter of 2013. Net interest income was N45.5billion and N45.2billion for Q1 and Q2 2014 respectively. It will be interesting to know if this is the new norm for the bank considering it’s only next to FBNH in terms of its ability to generate interest income.

Other Income: Zenith Bank like most banks have had to rely on cost cutting and other sources of income to shore up margins. It posted at least N22billion in each of the first two quarters of 2014. It’s important to note though that income from commission and fees dropped sharply this quarter to N11billion compared to N14billion for the first quarter of 2014. Zenith Bank averaged N12billion in income from commission and fees in 2013.

Operating expenses held steady at N37billion this quarter in line with what it posted in the first quarter of 2013. This is one key line to watch as Zenith’s operating expenses will have a major effect on whatever profit it declared in 2014. Cost to income ratio was 55% this quarter (by me estimates) and 54% the prior quarter. This is still within the bank’s average in the last 6 quarters. Taking it below 50% seems farfetched at this rate. This gives me huge concern for its ability to post a double digit profitability growth in the nearest future.

Profitability Growth – This is very important because of the effect it has on the company’s P.E ratios. It was flat quarter on quarter but rose 8% year on year (YoY). It suggest a PEG ratio close to 1x.

Share Price

In summary, this looks like a “stay the course” result rather than a game changer. My expectation for a N100billion profit after tax this year has been lowered quite alright but the fact that it is able to post a 20% Return on equity makes the stock a must have if you are a value investor. Nothing here suggest a stock that is about to pop into a massive rally. I don’t expect a share price above N30 except, something “magical” happens in the coming months.

One magic that can help is if the market suddenly decides to give the stock a higher P.E ratio than it currently has. Zenith, like most banks have single digit P.E ratios. If the bank can pull off or suggest it can pull off a double digit earnings growth, then that magic will happen.

Zenith Bank 2014 H1 Results

Zenith Bank 2014 Q1 and Q2 Results

..