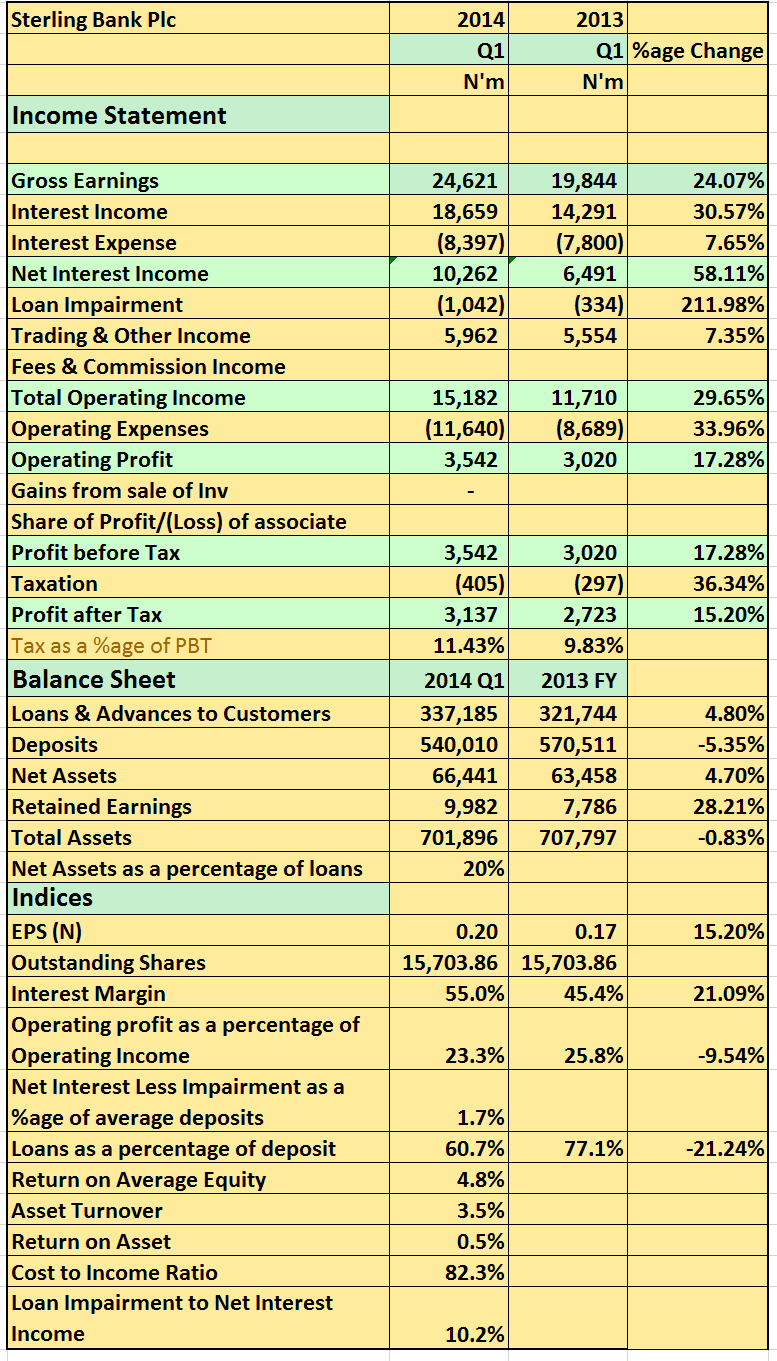

Sterling Bank Plc released its 2014 Q1 results showing Net Interest Income of N10.2billion 58% higher than the N6.4billion posted a year earlier. Other highlights of the results are as follows;

- Loan losses increased more than twice to N1billion (2013 Q1: N334million)

- Operating income however increased 30% to N15billion as its high net interest margins helped push income.

- Operating expenses weighed in higher YoY to N11.6billion a 34%

- Pre-tax profits rose 17% t0 N3.5billion compared to N3billion posted a year earlier.

- Interest margin was 55% compared to 45% in 2013 Q1

- Loans as a percentage of deposits dropped 21% this quarter to 60.7% compared to 77% at the end of 2013

- Cost to income ratio for the quarter was a high 82% by our estimates and way above industry average.

- Return on Equity for the quarter was 4.8% fairly lower than those of the tier 1 and 2 banks.