Oando Energy Resources (OER), a subsidiary of Oando Plc released its 2013 FY results showing revenues declined 5.9% to $127million as crude oil production dropped. The company also posted a loss after tax of $38.2million or N6.1billion (2012 PAT: $16million or N2.6billion).

They blamed the loss on interest charges arising from the Conoco Phillips deal costing the company about $55.4million (N8.9billion). According to ARM review, earnings were also adversely impacted by general and administrative expenses, which more than doubled YoY to $42.6 million (N6.8 billion) in 2013. In particular, the latter rise was driven by a 6-fold spike in ‘consulting and professional fees’ to $21.5 million (N3.4 billion) in 2013 which is again likely related to the COP deal which was meant to be completed in September 2013.

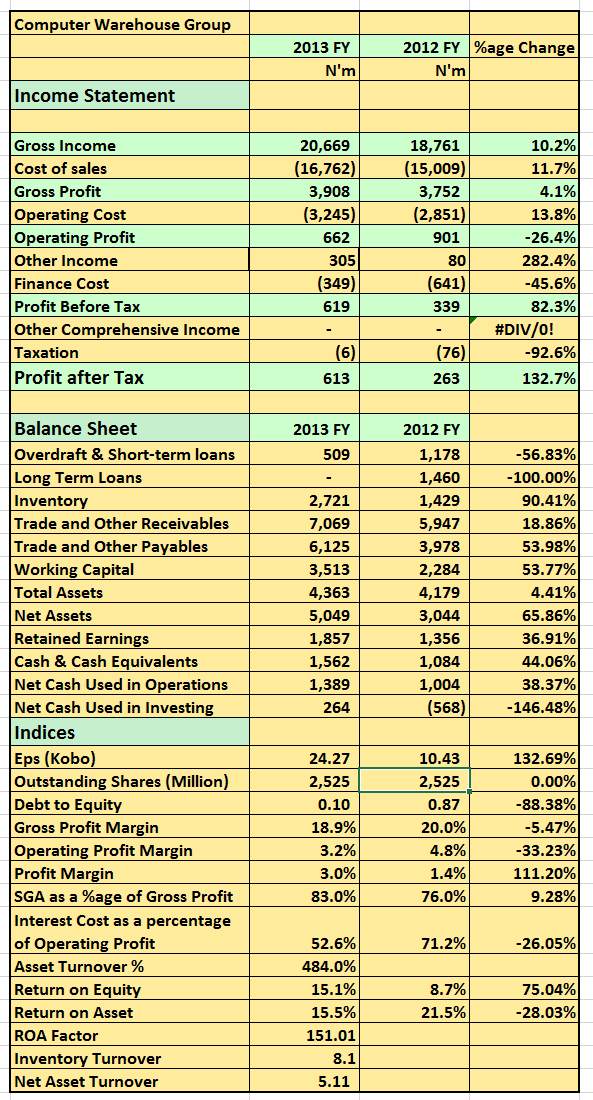

These are highlights of the results as released by OER

Operational Highlights

- Produced (Sales) 1.457 Million Barrels (mmbbls), which averaged 3,991 barrels per day (bbls/d) in production for the year ended December 31, 2013. This represented a 1% decrease from the prior fiscal year;

- Average gross sales price realized per barrel of oil produced was $110 for the year ended December 31, 2013;

- Capital expenditure of $120.0 million for assets in 2013.

- Drilled 8 new development and exploration wells in 2013, adding 4,890 bbls/d of production capacity.

- Progressed construction of the 45,000 bbls/d Umugini pipeline, designed as an alternative evacuation route for the OML 56 asset. Construction is expected to be completed by November 2014;

- First oil from Akepo planned for Q3, 2014; and

Commencement of production from Qua Ibo anticipated in Q4, 2014.

Financial Highlights

- Revenue was $127.2 million for the year ended December 31, 2013. This represented a 6% decrease from the prior fiscal year. The decrease was primarily a result of increased crude losses due to crude oil theft from the OML 56 asset;

- Net Income was $(38.2) million for the year ended December 31, 2013. The net loss was a result of financing expenses relating to the deposit paid for the COP Acquisition;

- Cash flow from operating activities was $77.4 million, prior to adjustments in working capital, for the year ended December 31, 2013. This represented a 30% decrease from the prior fiscal year;

- Cash and cash equivalents were $12.7 million for the year ended December 31, 2013. This represented a 63% increase from the prior fiscal year; and

- Working capital deficiency of $661.0 million, largely due to borrowings of $620.8 million as at December 31, 2013. This represented a 23% increase from the prior fiscal year. The increase was primarily a result of additional loans used to finance the COP Acquisition. Approximately $614 million of these loans were converted to equity through the issuance of 432,565,768 shares and 216,282,884 warrants on February 26, 2014.

See full press release