Chellarams Plc 2013 H1 Results ↓

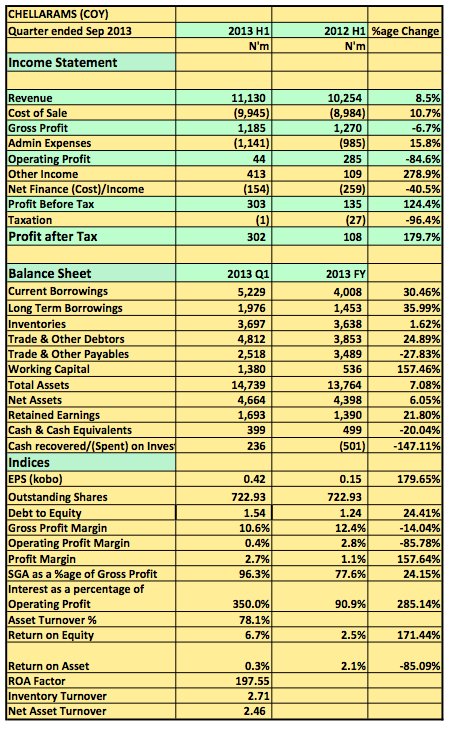

Chellarams Plc released its 2013 H1 results showing revenue rose 8.5% from N10.2billion (2012: H1) to N11.1billion (2013: H1). Gross Profit however dropped 6.7% to N1.1billion compared to the N1.2billion it posted a year earlier. Pre-tax profits rose 124% to N303million from N135million posted a year earlier.

Key Highlights[upme_private]

- The result looking flattering on surface but a further analysis indicates it is not all rosy

- Operating profit which is a better measure of a company’s organic performance showed the company posted N44million a whopping 85% drop from the N285million posted a year earlier

- The drop basically reflects the poor single digit sales growth.

- In fact on a QoQ basis, Revenue dropped 7%. The company also made an operating loss of N22million this quarter and a pre-tax loss of N73million this quarter as well.

- The pre-tax profit posted is basically on the back of other income recorded in the first quarter interim results.

- Chellerams has been faced with operational challenges since 2011. Its investments in the KFC Franchise is a welcome one and the same store expansion drive of the franchise offers it growth in revenues.

- Chellarams is not on our radar

Chellarams Nigeria Plc released its 2013 H1 results in the website of the NSE[/upme_private]