Newspaper reports today confirm what the Government has been saying recently about their plans to increase import duties on motor vehicles as part of their new National Automative Policy aimed at improving local production of Cars. Whilst it is positive to encourage local production of cars in the country, this Government once again is showing it lacks the basic understanding of the effects of trade policy.

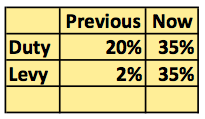

Whilst this rates have not been officially published by the Governments, initial reports suggest the following;

When you import a car?

When you import a “Tokumbo” Car that cost you N1million in FOB Value, you pay an extra N700,000 in Custom Duty and Levy. This is minus demurrage, taxes and any other applicable cost that will surely be incurred in trying to clear the vehicle.

The rest of the tariff according to the Punch Newspaper is as follows;

The document, with reference number BD/FP/DO/09/189,

- fully built commercial vehicles would attract 35 per cent duty but no levy imposed. I guess this means commercial vehicles will cost only 35% more in Levy but no duty will be imposed

- Local assembly plants shall import completely knocked down (vehicles) at zero per cent duty; and semi-knocked down (vehicles) at five per cent duty. This probably means vehicle parts imported by Local Assembly plants like Honda, Toyota will not incur any custom duty if they are vehicles that are Completely Knocked Down (CKD). Will this make car parts cheaper? I doubt it! Not until there is clear transparency in how they price their vehicle parts.

- Local assembly plants shall import fully built unit cars at 35 per cent duty and 20 per cent for commercial vehicles without levy, respectively in numbers equal to twice their CKD/SKD kits. It appears the likes of Hyundai, Honda, Toyota etc now pay less duty when importing vehicles compared to ordinary Nigerians. They only get to pay 35% duty whilst we pay 35% duty and 35% levy.

- Imported tyres would also cost more as from next year as 20 per cent duty and five per cent value added tax have been placed on tyres of cars, buses and lorries. This is obvious as cost of buying tyres will probably increase immediately

- Local tyre manufacturing plants are to import tyres at five per cent duty in numbers equal to twice their production for two years from the date of commencement of production,” it stated. They want to support the local tyre industry which has collapsed in recent years. Probably good for the likes of Dunlop Plc

- Similar high tariff will also be charged on used vehicles, according to the document. It added that the Nigeria Customs Service “shall use the value of a new vehicle depreciated by 10 per cent per annum, implying 10 years period of cars and by seven per cent per annum implying 15 year period for commercial vehicles. In either case, depreciation should never be below 30 per cent of the value of the new vehicle equivalent.” It will be interesting to see how this works out

Despite all the above, the business of importing cars individually in Nigeria is a very complicated affair. Most people go about this by simply dealing with Clearing Agents as it seems the more complicated things are the better for Agents. Typically, when you import a car, you just give your Clearing Agent money (based on a generally accepted cost of clearing each car) and he does the rest. He pays the Custom Service and other Agencies involved in clearing. So, the bottom line here is that expect your clearing cost to double by next year at the least.