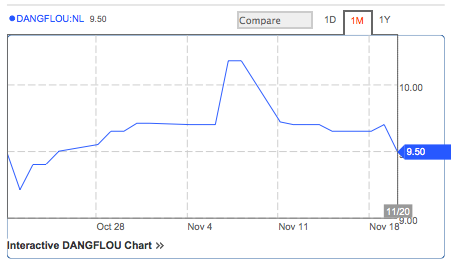

Dangote Flour Mills released its 2013 9 months results with the company posting a pre-tax loss of N8.4billion. The results was as disastrous as it can ever get and even thought the company has been mired in problems in recent quarters, Q3 was certainly one of the worst results I have ever seen. I have reviewed the results pointing out what was wrong with it. However, the company also offered to explain why things are so bad and what the future outlook might look like for the company. Here are the key issues they raised;

The Group’s trading performance for the period under review is disappointing. Turnover of N29.96billion was 5.8% below the corresponding prior year period. Group profitability was negatively affected by ongoing volume pressures, as well as significant input cost inflation, which could not be fully recovered through price increases. Operating loss before interest and tax of N6.0billion included non-recurring abnormal costs of N1.8billion relating to retrenchment costs, stock write-offs and increased provisions against long outstanding debtors and historical liabilities. The net financing cost of N2.3billion is reflective of the group’s increased debt and high cost of borrowing, which is currently under review.

Turnover was adversely affected by the continued moderation of credit extension in the Flour business, a three-week shutdown of the Pasta manufacturing facility in order to re-establish Good Manufacturing Practices (GMP), as well as a slowdown in sales volumes that resulted from price increases implemented on Pasta and Noodles during the last quarter of the financial year. The Group’s performance is also a reflection of the challenges arising from the existing excess capacity across particularly the wheat milling industry, which limits pricing power for the Flour business.

As part of the integration process, additional costs were also incurred in improving the business’ supply chain infrastructure, enhancing the internal control environment as well as strengthening the business’ management team.

Subsequent to the year-end, agreement has been reached to sell the group’s interest in its packaging subsidiary, Dangote Agrosacks, to Dangote Industries Limited for N7.55billion. The sale of this non-core asset will reduce the group’s overall debt, which currently accrues interest at 15%. The results of Dangote Agrosacks for the nine month period ended 30 September 2013 have been reflected as a single line item in an the income statement as relating to a discontinued operation and consequently have been excluded from group turnover and group operating income. Furthermore, the assets and liabilities of Dangote Agrosacks have been reflected as held for sale as at 30 September 2013. The remeasurement of the net assets of Dangote Agrosacks to fair value of N7.55billion as at 30 September 2013 has resulted in an abnormal loss of N2.6billion, which is included in the loss from discontinued operations of N453million.

Divisional Performance Flour

Sales volumes dropped by 4.7% relative to the previous corresponding period, and the gross profit was adversely affected by the raw material cost push that could not be immediately recovered through price increases. Significant improvements in manufacturing efficiencies and plant maintenance standards have been attained, and this has resulted in better consistency in product quality and customer service levels. However, sales volumes have remained under pressure as the business continues to contend with a highly intense competitive landscape and limited pricing power on the current product and brand portfolio.

Dangote Pasta

The Pasta business experienced significant challenges during the period that arose from product quality and supply chain issues. The manufacturing facility was shut down for a three-week period during the year in order to address production inefficiencies and to ensure consistent product quality and service levels. Consequently, sales volumes were negatively affected during the period and turnover declined by 34.1% relative to the corresponding prior period. Good sales volume growth momentum was achieved following the interventions and into the third quarter but a price increase during the fourth quarter resulted in a significant slowdown in sales momentum.

Dangote Noodles

The Noodles business delivered a 17.8% growth in turnover on the back of positive sales volumes and an improved sales mix. During the period under review, the Noodles manufacturing facility in Calabar, which had previously been moth-balled, was re-commissioned in order to supplement market demand.

Outlook

The group is achieving steady progress in transitioning its business in a challenging trading environment. A significant amount of management’s attention has been focused on stabilizing the delivery platform of the business during the year under review. This has resulted in significant improvements in supply chain efficiencies, consistency of product quality and customer service levels.

However, much work is still required in order to complete the full integration process. Focus is now shifting towards optimizing the business’ infrastructure and enhancing competitiveness for future growth.

Its a very challenging period for the company at the moment, however I will bet on Tiger Brand, the new owners turning the company around. It is obvious the company’s business model was flawed and wasn’t prepared for the competition awaiting it. They also were not nimble enough to adapt to price adjustments in the market and did poorly at hedging against raw material cost. The company also apparently invested heavily in capex (over N9billion spent since 2011) which unfortunately did not help turn things around.