Dangote Flourmills 2013 9 Months ↓

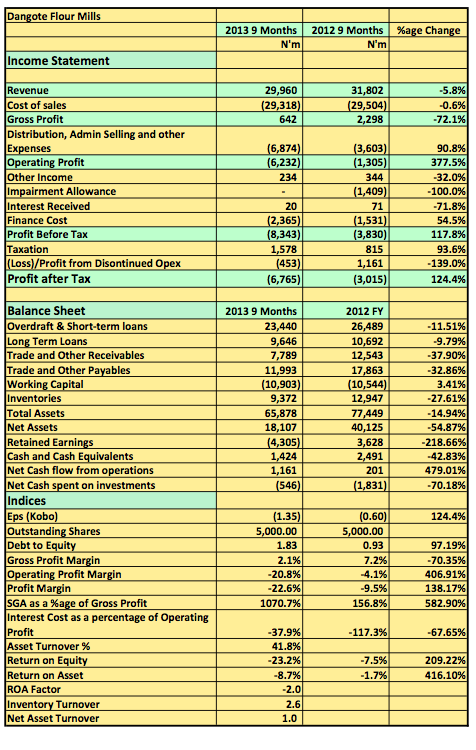

Dangote Flour Mills Plc released its 2013 9 Months results showing revenue dropped 5.8% N29.billion (2012 9 Months: N31.8billion). Operating loss increased 377% to N6.2billion (2012 9 Months: N1.3billion loss). Pre-tax profits also dropped by a massive 117% to N8.3billion (2012 9months: N3.8billion).

Key Highlights

- This was another disastrous result for the company. This is now the 7th straight consecutive quarter of pre-tax losses for the company starting from 2012

- In fact, this quarter (July – September), the company only posted a revenue of N577million compared to N15.3billion in the prior three months and N14billion for its Q1 2013 results.

- Operating loss this quarter was also the highest in a 21 months at N4.7billion.

- The company also faces severe cash constraints as working capital remains high at N10.9billion

- This result basically pushes retained earnings into negative territory with the company now carrying negative reserves of N4.3billion

- Dangote Flour Mills still has external debts (including related parties) of over N33billion which is now 1.83x its net assets

- Dangote Flour Mills offered to explain why their results as been disastrous lately putting the blame squarely on dwindling sales, significant input cost inflation, as well as “excess capacity across particularly the wheat milling industry, which limits pricing power for the Flour business”

- The share price dropped 2% to N9.5 on the day the result was released. Price to book ratio is still at 2x with support probably still coming from the fact that the company’s shares is mostly controlled by Tiger Brand

- Minority Shareholders should be very worried however, before taking any drastic action a statement of intent to turn things around from Tiger Brand may cool nerves

Dangote Flour Mills Plc released its 2013 9 Months results in the website of the NSE

.gif)