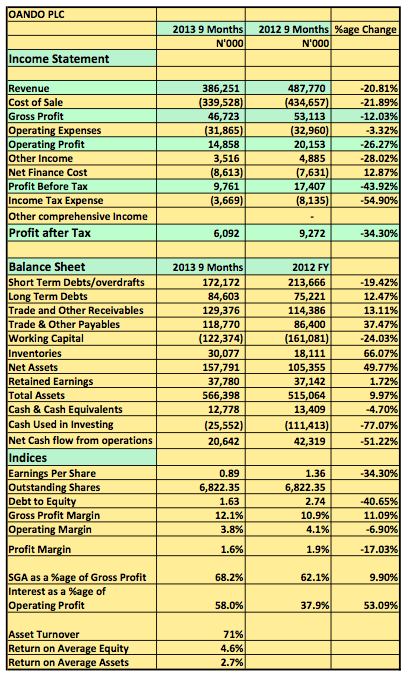

Oando Released its 9months results showing revenues dropping 21% YoY to N386billion (2012 9months: N488billion). Pre-tax profits also dropped 44% to N9.7billion (2012 9 Months: N17.4billion). The results in normal circumstances should be considered nerve wracking pulling the share price downwards. But we are in a bull market where every bit of information, tangible or not, feeds the bull as it gallops its way to the top. Surely, price earnings remain very low and share price is still at a 70% discount to book value.

Just look at the margins – revenue down 21%, Gross Profit down 12%, operating profit down 26% YoY respectively. The company is also still highly leveraged with over N250billion in loans, 1.6x its Net Assets. Cash flow is also being squeezed with the company having to rely heavily on overdrafts to finance its operations. Negative working capital is not new in the industry considering how often Government owes them but Oando’s is self imposed….biting more than it can chew?

But I somehow get it, there is a self determination to diversify and consolidate position as a leading indigenous oil company particularly in the upstream sector. But this is an industry bogged down by drought in policy making, corruption and a shift in the way oil is being produced. Ironically, the latter is why there is so much hope in Oando. The Conoco Philip deal is central to Oando’s resurgence as an indigenous power house in the sector, therefore confirmation of its imminent completion is needed to boost share price and instil confidence. At 45,000 bpd the Oil block may seem like a gold mine. But remember Cocnoco Philips can’t be abandoning such an “lucrative asset” if it doesn’t believe value lies else where. Conocco Philips is basically using the money to acquire a stake in a Shale Gas asset in the US. A popular investor once said

People however forget the asset costing about $1.7billion is mostly financed via debt, another erosion to shareholder receipts. Its a lucrative acquisition in the short term considering oil prices have been fairly stable but long term risk exist and persist. Besides it’s either the proceeds go to the bank who financed them or shareholders who may face further dilution should they decide to raise more equity (which is inevitable) to repay the loans. Also, very few know if the Oil Block being acquired is worth the price tag?

No matter the approach, the current share price appreciation is fairy tale amidst the nightmarish fundamentals it currently. It is no more than a speculative reaction to a piece of eagerly awaited news this “wonder” market craves for. On the back of recent trends, I will not bet on the share price hitting N30 in a months time. Such is the bubble we are in.

Its the stock market of saying Merry Xmas in advance. LOL