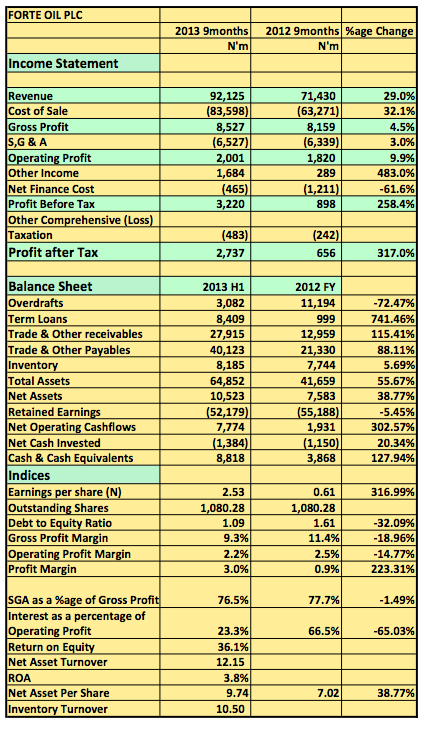

Forte Oil Plc released its 2013 9 months results showing a YoY 29% rise in revenue to N92.1million (2012 9months: N71.4million). Operating profit also rose 10% to N2billion YoY. Pre-tax profits also rose 258% to N3.2billion (N898million 2012 9months).

Key Highlights

[upme_private]Year on Year

- Forte Oil Plc in its H1 earnings update had projected a profit after tax of N2.6billion and with this result beat its earnings expectations by N137million

- The YoY 29% increase in revenue kept pace with the 21% increase as at June 2012. Only the first quarter of 2013 did revenues not beat year on year estimates.

- The increase in revenue is perhaps a reflection of the company’s massive expansion of filing stations around the country as well as introduction of lubricants and other petroleum products.

- The company CEO in its last earnings report also revealed that “optimised distribution and logistics drove down cost of administration, whist increasing overall profitability”. That trend continued as distribution expenses dropped 7% to N2.2billion. Admin expenses however rose 9% to N4.3billion. Operating expenses rose 3% YoY to N6.5billion.

- Cost of sales also came in quite high at N83.5billion in the period under review. The 32% rise in cost of sales basically blew out the increase in revenue posted. In fact, Gross Profit margin was 9% this period compared to 11% a year ago.

- The company reduced its debt by N1billion carrying a total bank debt of about N11billion. Debt to equity is now 1.09X.

- Finance cost as a percentage of operating profit dropped to 23% from 66.5%. This drop is quite significant and needs further explanation. We do not expect this drop despite the N1billion drop in external debts. It is therefore suggested that the drop may have been as a result of capitalisation of debt cost or that interest based on refinanced loans are yet to kick in.

- Return on Equity of 36% is one of the best in the industry. However, one will have to factor in the negative retained earnings of N52.1billion.

- The company and analyst all forecast “robust dividend” at the end of the year. I don’t see that happening if they continue to carry this negative reserves. Except of course they plan to pay dividends out of profits from a different kind of business.

Quarter on Quarter

- The third quarter results extrapolated shows a weaker third quarter compared to the previous quarters in terms of core operating activities. However, a surge in other income will help make the 3rd quarter its best this year. At N1.5billion in pre-tax profits it surpassed Q2 N1billion and Q1 N633million.

- Interesting to note also that operating expenses was lowest this quarter compared to the prior quarters this year. It will be interesting to see if the company maintains this trend in Q4.

- Forte Oil Plc share price gained 10% at close and rose to N61.24. It has returned 527% in the last one year.

Forte Oil Plc released its 2013 9 Months results in the website of the NSE[/upme_private]

..