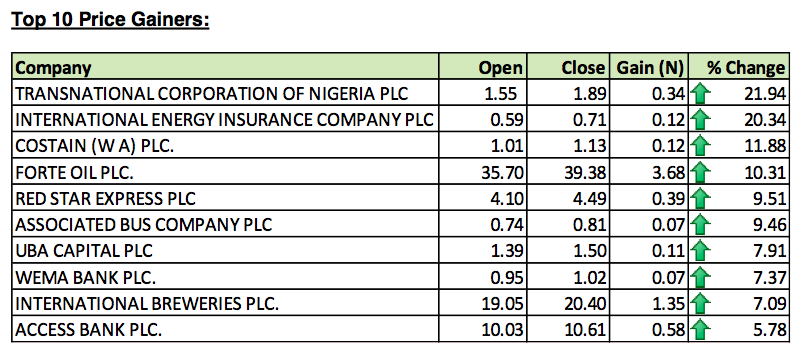

According to the NSE Forty nine (49) equities appreciated in prices during the week higher than forty three (43) equities of the preceding week. Twenty four (24) equities depreciated in prices lower than thirty two (32) equities of the preceding week, while one hundred and twenty four (124) equities remained unchanged higher than one hundred and nineteen (119) equities of the preceding week. See below;

Is there any stock up here you will like to own? We own shares in ABC which currently is one of our most under-performing stocks.

Jos International Breweries continues its decline, loosing another 13.7% on the bounce. It has now dropped over 50% in value from its high of N9. Courteville Business Solutions another stock in our portfolio seem to be an investor delight. It has declined to 61kobo from its high of 75kobo just under two weeks ago. This indicates massive profit taking.

Hi ugodre.thank you for the good work you are doing for all.pls why is courteville share price falling seriously.have they credited the bonus?

Its a cyclical thingy I think. People are taking off profits and reinvesting. But I will dig in further to see if there is something I else affecting the price. Another one too is ABC.

By the way they have credited Bonus (1/5). But not sure that is the reason why the shares in dropping like that

Ok.but i checked my cscs acct at my broker a month ago but the bonus never enter.i want to be sure before i check it again because of my brokers charge for printing it which is 550.00.So have you gotten yours?meanwhile,do you still see it as a good buy now because i want to add more at this current price.thanks

I’m thinking of buying more though but after I confirm a few things with my broker. Meanwhile, why don’t you just pay CSCS a one time fee of N5k annually. That way you don’t need the stockbroker to check your statements. I just checked mine online now and didn’t see a bonus yet…though I bought some on closing date mad the rest after closure.

Alright.how do i get the online access?do i need to meet my broker for it.secondly,i bought starcomms and unhomes few years ago in volume but now i’m trapped.is their any latest development in these stocks or do you think there is hope in them again?

Alright but where do i pay the 5k…my broker or cscs?secondly,is there any hope in starcomms and unhomes?lastly do you see japaul oil as a good buy at 0.50k?i want to get it also with courteville and unity bank.thanks

You can call this number 07025768500 they will give you CSCS bank details where you can pay top. Don’t pay into a personal account. As per Union Homes and Starcomms they are companies that are facing major financial stress and loosing business fast. It will be a while for the recover unless there is a merger. That why I like to buy companies with sound fundamentals and take my time to analyse them, that way I go to sleep without worrying much.

Thank you for the cscs acct information.I will work towards it.pls,as an analyst,which of these four companies do you think is good fos one to buy their shares:Courteville,japaul oil,ikj hotel and unity bank?

I have shares in Courteville and may increase my holdings. Japaul, Unity and Ikeja Hotels are a no no for me. Weak fundamentals

i would like go into investing but i need

advice can you please help me thank you