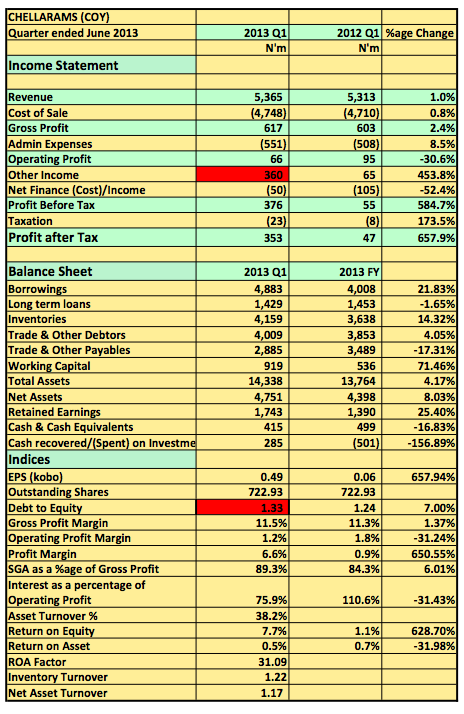

Chellarms Plc released its 2013 first quarter results showing revenue grew 1% to N5.3billion when compared to the same period 2012. Operating profit dropped 31% to N66million compared t N95million a year earlier. Pre-tax profits however, rose 584% to N376million (2012 Q1: N55million).

[upme_private]Key Highlights

- Profits rise was mainly due to income from non core operating income (other income). The results released did not provide details.

- Other income is usually not a good metrics for measuring a company’s performance because it is unstable. However, this is welcomed

- Finance cost dropped in half this quarter compared to last.

- Debt to equity is still very high and actually increased to 1.33.

- The company generated negative operating cash flows of N1.1 billion and they had to rely on income from investments in associates (N300m) and more debt to remain financially viable.

- Selling and General Expenses as a percentage of Gross Profit is 90% and not what any serious company should be averaging.

- This is Not a company on my radar.

- Bottom Line, I do not consider buying the stock

Chellarams released its 2013 Q1 results in the website of the NSE[/upme_private]