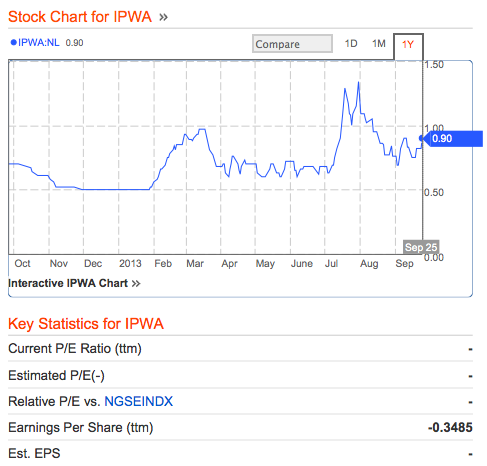

Wonder stocks are making an impression in the Nigerian Stock Exchange. Like Jos Breweries they have been posting higher valuations as their share prices continue to rise. Reason why, I don’t know. IPWA (ever heard of them) is now another stock that topped the list today. See below;

ONE YEAR SHARE PRICE CHART HISTORY

5 YEAR SHARE PRICE CHART HISTORY

By the way the company was listed as one of those that failed to release their annual reports by the Nigerian Stock Exchange. Jos International Breweries, another wonder stock lost 10% today again and has now lost 40% in value since it reached its one year high of N9.9 on the 17th of September 2013.

I think the Jos Breweries story was linked to something about the Plateau state government paying back its debt https://www.bloomberg.com/news/2013-08-30/jos-breweries-gains-to-2-1-2-year-high-as-debt-paid-lagos-mover.html

Still no reason why it should rise over 200%YTD

True that but the stock is not very liquid so perhaps the coy is being primed for a sale which is why the insiders are pushing it higher. NB still has an inorganic strategy and who knows maybe Diageo or SABMiller are preparing to buy the coy. Champion Breweries had a similar rally despite a rack of losses only for us to post rally of course that Heineken was buying it up.

Fine but innocent investors don’t know that. Some have actually bought for N9!!! Without understanding the reason behind the rally.