If you own shares in publicly quoted companies, then it is most likely that you may have been issued bonus shares before. By definition bonus shares is return on investment issued in the form of shares to a shareholder of a company. It is also called a Script dividend. It is a dividend because dividend can be either paid in cash or through shares. When a company issues bonus shares the owners of those shares can then sell it at the stock market should they decide to want cash. They could also keep the shares if they do not wan the cash.

Technically, Bonus issues do not dilute the ownership of the company as it is issued pari passu to the number of shares held prior to the Bonus Issue. That is why when a company issues Bonus shares it is usually in the form of X nos of shares for every X no of shares held. For example 1 share for every share held means shareholders of the company will get double what they had before. 1 share for every 2 held means they get half of the shares they had before as bonus etc.

Whilst Bonus shares does not dilute the company ownership structure it however affects the Earnings Per share and the share price. For example, a company has a market valuation of N100m and total outstanding shares is 1million units. It also made profits of N10million during the period. At the end of the year its declares a bonus issue of One share for every share held and had 1million shares.

Effect:

Earnings Per Share

Pre-Bonus Issue – N10m/1m shares = N10 per share

Post Bonus Issue – N10m/2m = N5per share

Market Price per share

Pre-Bonus Issue – N100m/1m = N100

Post Bonus Issue – N100m/2m = N50

This is called the marked down price.

Despite the above, it is often obtainable that the share price of a company can increase substantially on announcement of a bonus issue even if it hasn’t yet been issued. The market sees this as a incentive to purchase the company stocks before the Bonus is issued and shares is marked down thus driving the share price up.

Companies pay Bonus issues sometimes if they believe they can make better use of their cash and rather than leave shareholders without a form of returns they issue them Bonus shares where they can get that same returns by selling the shares. It could also be that the company does not have enough cash to pay dividends. Another reason is that the company may believe the share price of the company has a high value and may be best for the shareholders to cash out on that value by giving them the shares which they can then sell in the market.

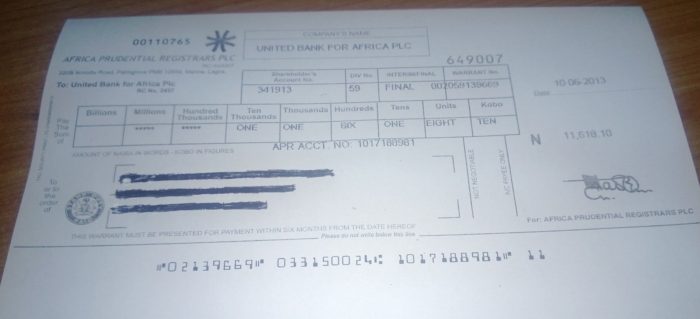

Companies can also issue a hybrid of Cash and Script dividends. Bonus shares are usually represented by a Share Certificate. It can also be via an electronic form.