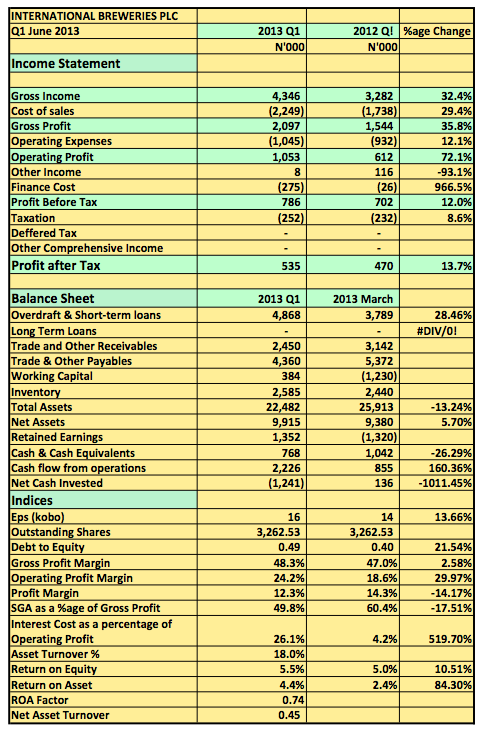

[upme_private]International Breweries Plc (INTBREW:NL) released its 2013 Q1 results showing revenue rose 32.4% t0 N4.34billion (2012 Q1: N3.82billion). Gross profit rose 35.8% to N2billion (2012 Q1: N1.5billion). Operating profit at the end of the period also rose 72% to N1billion helping the company declare a pre-tax profit of N786million (2012 Q1:N702million).

Key Highlights

- Revenue Increase of 32.4% followed the 75% increase recorded at the end of 15months to March 2013. The growth trajectory has been double figures for the company for years now and showing no signs of abating.

- This was even prior to the entry of SAB Miller.

- Gross Profit margin improved slightly despite 30% growth in cost of sales. This can be attributed to the rise in revenue.

- Operating expenses was also on the rise despite only chalking off 50% of Gross Profit compared to 60.4% the year before.

- Working capital has turned positive even though trade and other payables still remain high.

- The company also increased its borrowing during the period by 28%. Debt to Equity now stands at 50%. Interest cost also increased to N275million this quarter alone and look set to cross N750million by year end if debt is not repaid.

- The interest rate came at an average of 6% this quarter…a high figure in my view

- The rise in finance cost affected the pre-tax profits growth at the end of the period

- Share price was N21.5 and has dropped 17% since the result was announced. The company’s price earning ratio is still 23x and still has a very high price to book ratio (one of the highest in the NSE) multiple of 7.5x.

- The high valuation placed on this stock may be as a result of its revenue growth but still seem unjustifiable to me.

International Breweries Plc released its 2013 Q1 results in the website of the NSE[/upme_private]