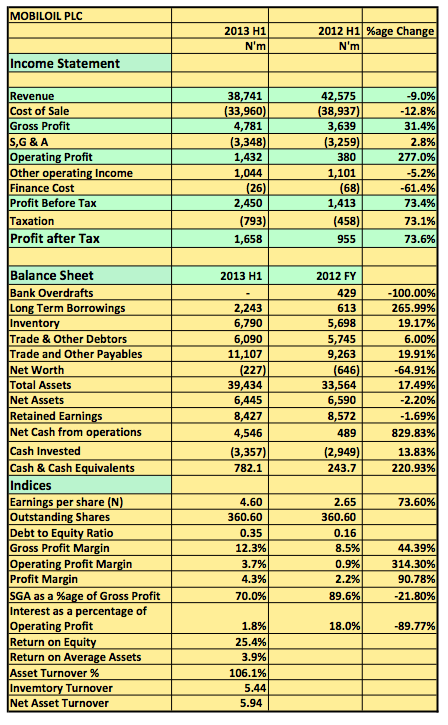

[upme_private]Mobil Oil Plc (MOBIL:NL) the downstream arm of Oil Giant Exxon Mobil, released its 2013 H1 results showing revenue decreased 9% to N38.7billion when compared to the same period last year (2012 H1: N42.5billion). Despite a drop in revenues operating profits rose 277% to N1.4billion (2012 H1: N380million). Mobil Oil ended the first half of its financial year with a 73% rise in Pre-tax profits to N2.4billion (2012 H1: N1.4billion).

Key Highlights

- The bottom line appears flattering on the surface considering the 73% rise in pre-tax profits and 277% rise in operating profits.

- This is because despite a drop in revenues the company still ended up with a results better than the prior year

- The major reason for this is the 13% drop in cost of sales this period compared to the last.

- By dropping 13% in cost of sales the company basically saved itself about N5billion direct cost which it used to offset the N3.8billion it lost in revenues (when compared to the prior period). The net of this is N1.1billion which basically is the profit that we see.

- The drop in cost of sale is particularly noticeable considering that the likes of Total and Forte Oil all saw a rise in Cost of sale during the same period as well. Mobil has for two years running posted a drop in PAT.

- Mobil Oil also took on about N900m in additional loans taken up total loans borrowed this year to about N1.6billion

- Mobil currently trades at 15x its trailing earnings per share and is also priced at 6.5x its book value per share.

Mobil Released its 2013 H1 results in the website of the NSE[/upme_private]

Mobil Oil Plc (MOBIL:NL) the downstream arm of Oil Giant Exxon Mobil, released its 2013 H1 results showing… https://t.co/1eqDAEk7rZ

Mobil Oil Plc (MOBIL:NL) the downstream arm of Oil Giant Exxon Mobil, released its 2013 H1 results showing… https://t.co/lVBJXF1YKy

Earnings Analysis 2013 H1: Lower Cost Help Mobil Oil Plc Post 73% Rise In Pre-Tax Profits |… https://t.co/ZZxBFlFqqJ