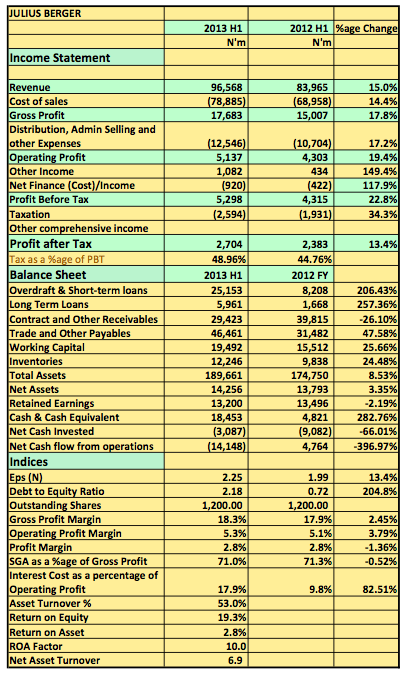

[upme_private]Industry giant Julius Berger Plc (JBERGER:NL) released its 2013 H1 results with revenues rising 15% to N96.5billion (2012H1: N83,9billion). Gross Profit also rose 17.8% to N17.6billion during the first half of 2013. Operating expenses at N12.5billion was 71% of Gross Profit. Operating expenses also rose 17% higher than what was incurred in the prior year. Pre-tax profits rose 22.8% to N5.2billion at the end of the period under review (2012 H1: N4.3billion).

Key Highlights

- Revenue is divided into Civil Works Revenue| Building Revenue| Services. Civil works contributed N64.7billion (2012 H1: N56.2billion) to revenue pool growing 15% year on year. Building revenue on the other hand contributed N30.9billion (2012 H1: N26.8billion) rising 15% as well. Revenue from Services was N965.6million (2012 H1: N839.6m) another 15% increase.

- Profit from the respective segments were Civil N8.8b (2012H1: N6.7billion)representing a 31% increase over the same period last year and a 13.6% profit margin. Building works contributed N1.8billion (2012H1: N1.4billion ) representing a 28.5% growth and 5.8% profit margin.

- Julius Berger remains highly leverage as it continues to rely on term loans to finance its huge operations. It currently owes a combined N31billion in total external loans compared to N9.8billion a year before.

- The company reveals that it obtained a fresh loan from HSBC Bank london at an interest rate of Euribor plus 1.65% margin. The loan is to finance supply of capital goods and related services.

- Return on Asset is shy of 3% for the period and may rise to about 5% at the end of the year. This suggest a comfortable cover for interest.

- Included in contract and other receivables are gross amounts due from contracts (N28.4 billion), trade receivables (N9.0 billion), advances to suppliers & sub-contractors (N5.1 billion) and retentions amounting to N1.6 billion expected to be recovered within one year. Contract receivables expected to be recovered after more than one year amount to N22.6 billion.

- The company also has about N38billion in taxes (VAT & WHT) recoverable from the Government. Usually these are set off against tax payable

- Included in trade and other payables are advance payments received from contracts (N96 billion), third party advances (N1.9billion) and trade payables amounting to N15.9 billion.Trade payables, amounts owed to joint ventures, other taxation and social security costs, other payables and dividends are classified as other financial liabilities.

- The long term portion of Trade and Other Payables was about N84.5billion and represent advances given to the company for contracts.

- The company has huge cash of N18.4billion

- Return on Equity is about 20%

- Julius Berger Currently trades at 12x its trailing EPS.

Julius Berger Plc released its 2013 H1 results in the website of the NSE[/upme_private]