Last week the Central Bank of Nigeria issued a press release confirming that the Management and Board of Skye Bank had agreed to resign paving the way for a new Board.

The Central Bank claimed that its decision to infuse a new Board and Management for Skye Bank PLC “is a proactive regulatory action meant to ensure that the bank does not continue to fail in its relevant prudential ratios.”

We explained in an article last week that Skye Bank had failed prudential requirements around its Capital Adequacy Ratios, Liquidity Ratios and non-Performing Loan ratios. These ratios are set by the CBN as a trigger to proactively determine banks that might be in danger of falling into distress.

The CBN is said to have conducted a stress test on commercial banks recently however that report is yet to Published, leaving investors to continue to speculate on which bank might be next. According to a recent Reuters article, the CBN Banking supervision director, Tokunbo Martins was reported to have said that “one or two” commercial banks had failed liquidity tests but that they were not in the same situation as Skye. “We have our eyes on one or two other banks right now but they are not in a state of distress…..We have our eyes on all banks.”

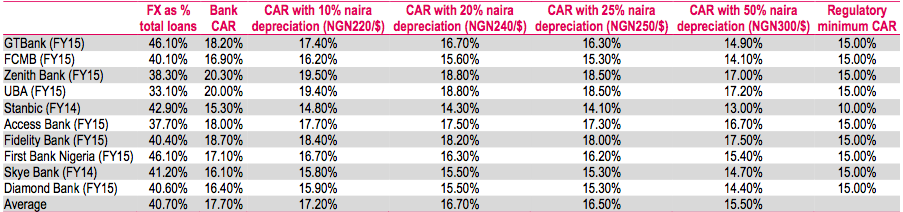

So what banks are they looking out for? This table from a report on Rencap about Nigerian Banks provides an insight;

The table above reveals what could happen to a bank’s Capital Adequacy Ratios (CAR) if the exchange rate depreciates. The Naira has so far depreciated by over 45% dropping from N197 for N282. From the table above Diamond Bank and FCMB sticks out.

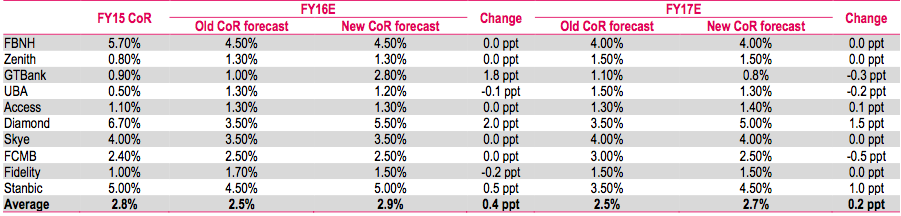

In terms of cost of risk Diamond Bank, FBNH and Stanbic IBTC also standout as the banks with the highest COR. Cost of risk refers to a banks portfolio of bad loans (that it as provided for) as a percentage of its nets loans. The higher this percentage the worse it is for a bank. From above, we can see that Diamond Bank’s 5.5% is well above Skye Bank’s projected 3.5%. A higher cost of risk indicates a high possibility that the bank’s profitability will decline leading to possible losses.

Diamond Bank for example reported an impairment loss of about N55 billion in the whole of 2015 and another N8.8 billion in the first quarter of 2016. FBNH the parent company of First Bank recorded an impairment loss of about N119.3 billion for the year ended December 2015 and another N12.7 billion in the first quarter of 2016. Stanbic IBTC is yet to release its results due to its squabbles with Financial Reporting Council of Nigeria.

We believe Diamond Bank, Stanbic and FBNH can raise enough capital to mitigate the risk of a lower capital adequacy ratio. However, genuine concerns remain for their share prices in the coming months. Even if these banks avoid board changes, they still face the risk of going through 2016 without paying dividends or rewarding shareholders in any way.

Skye Bank’s share price dropped by 8.4% to 87 kobo as investors dumped the stock following CBN’s actions.

Notable changes: This article was amended to correct an initial assessment about Stanbic IBTC’s projected Capital Adequacy Ratio (CAR). In analyzing Rencap’s report, the article implied that Stanbic IBTC could breach its CAR limits with a 50% Naira depreciation. This was wrong as Stanbic IBTC has a regulatory minimum CAR of 10%. As such a projected 13% CAR is still comfortably above the 10% minimum CAR. We thank our readers for brining this to our attention.