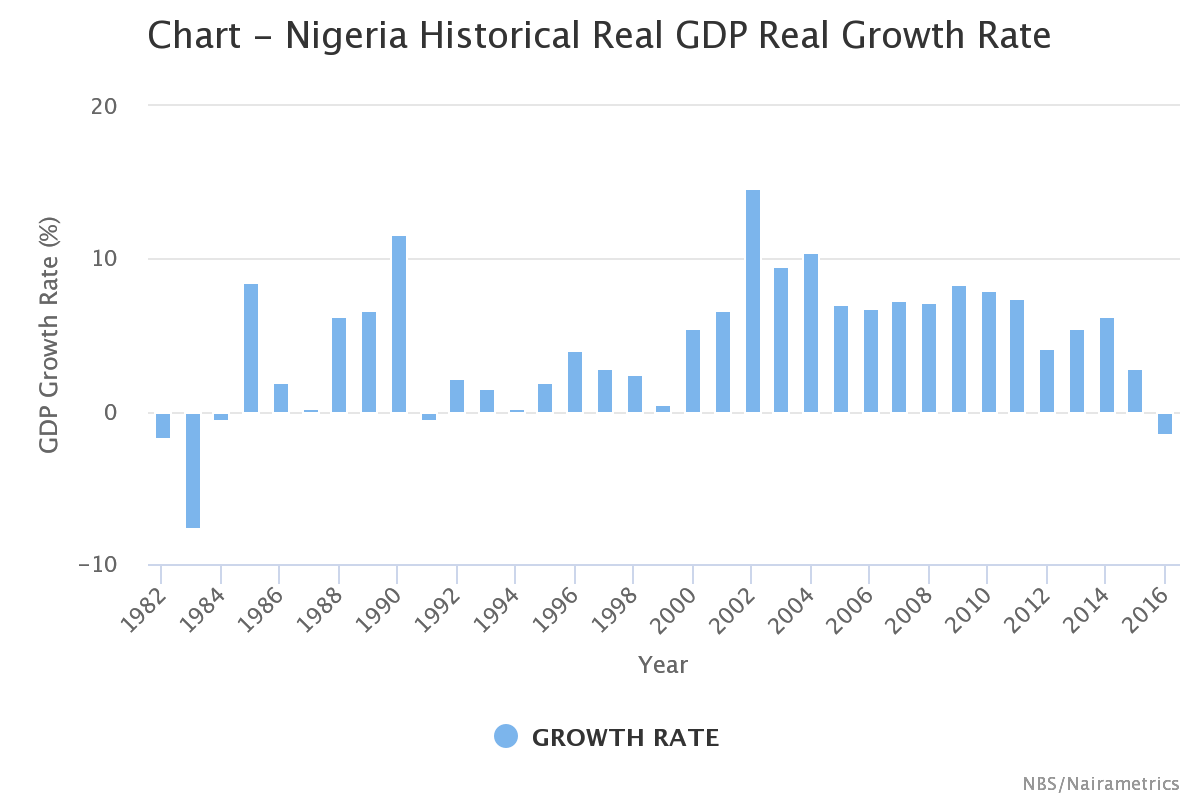

Nairametrics| The National Bureau of Statistics on Tuesday, released its 2016 annual GDP numbers, showing and as expected a contraction of about -1.51% for the year ended December 2016. This is Nigeria’s first negative GDP growth rate since 1991, ending a 25 year run of modest GDP Growth rate. Nigeria’s highest GDP growth rate remains 14.6%, recorded in 2006.

[wpdatachart id=10]

NBS Excerpts:

In the fourth quarter of 2016, the nation’s Gross Domestic Product (GDP) contracted by -1.30% (year-on-year) in real terms, from N18,533.75 billion in Q4 2015 to N18,292.95 billion in Q4 2016. This decline was less severe than the decline recorded in the previous quarter, of -2.24%, but was nevertheless lower than the growth rate recorded in the final quarter of 2015, of 2.11% . Quarter on quarter, real GDP increased by 4.09%, which partly reflects seasonal factors as well as a rise in the general price level.

[wpdatachart id=84]

Nigeria’s real GDP is now about N67.9 trillion while nominal GDP is about N94.1 trillion. The NBS did not translate Nigeria’s GDP to dollars making it difficult to determine Nigeria’s GDP compared to other countries.

NBS Excerpts:

Nominal GDP was N29,292,998.54 million at basic prices in the fourth quarter of 2016, which represents year on year nominal growth of 12.97%. In contrast to real growth, this is 5.84% points higher than the rate recorded in the same quarter of 2015, implying that the GDP deflator increased faster than the earlier period. For full year 2016, aggregate nominal GDP stood at N101,598,482.13 compared to N94,144,960.45.

Why the contraction?

According to the NBS, the contraction reflects a difficult year for Nigeria, which included weaker inflation induced consumption demand, an increase in pipeline vandalism, significantly reduced foreign reserves and a concomitantly weaker currency, and problems in the energy sector such as fuel shortages and lower electricity generation

Oil Sector

NBS Excerpts: For the full year 2016, oil production was estimated to be 1.833mb/day, compared to 2.13mb/day in 2015. This reduction has largely been attributed to vandalism in the Niger Delta region. As a result, the sector contracted by -13.65%; a more significant decline than that in 2015 of -5.45%. This reduced the oil sectors share of real GDP to 8.42% in 2016, compared to 9.61% in 2015.

Non-Oil sector

NBS Excerpts: For full year 2016, the non oil sector declined by -0.22% in real terms, compared to a growth rate of 3.75% in 2015, a difference of 3.97% points.

Some time we cannot predicts terrorism,or some rouge nations promoting terrorism due to their selfish aim for world domination,but we can prevent terrorism.but how ?take the bali attack in Indonesia,which killed close or more 200 people.indonesia have a population about 220 million with almost a moslem entity.i have watched the trial of one of the suspect.when he was sentenced to death he laugh and turn to his supporter.he was happy to meet his death,he had no regret on what he did..what reasons did they gave ? they said foreigners are taking over their country.just leave us alone.a few days ago a white American shot 3 people killing 2 Indians wounding a white innocent man,.the gunman said” you leave my country “we should not forget Mr Trump speech said”.build the wall”,,deport illegal immigrants.ban moslems from entering America.now is the American president behaving like a gangster ?he heated the suitiation leading to the killing of 2 innocent foreigners

Take this American attack on 9/11 on American world trade centre,they released pictures of those terrorist especially mohammed atta.the man does not look happy,he looks depressed.take the attack in London on the tube,the leader said those western Christians are killing their moslem brother,the leader was british born,at times we try to find excuses to do evil,call it religion.AS AN AFRICAN MAN I HAVE NO FAITH.I THINK ORGANISED RELIGION IS POLITICAL.I WORSHIP THE SPIRIT OF MY ANCESTORS.

nOW LOK AT STATS.govt choiced to destroy the country.it is not they do not know ,what to do.this is gross negligence,could book haram or delta militants actions prevented.i think It could be prevented,.religion can be a clock for evil,i was baptized as a roman catholic,but as I grew older,i thought there is something missing in my life.i have read the Koran,and the history of islam and the surging of islam,which I think is the only true organisedreligion.mohammed did not claim to be what he is not.some moslem may not agree with me.but I think he borrowed the spiritual elements from some where,he was illiterate.his massage is to purifies your soul.i did researches on Christianity and it’s history.it connect always to ancient Egypt.i decided to study ancient Egypt.i found this bible old and new testament is based on lies.all those history which the jews said are and their religion are not what they are, and their religion is based on falsehood all story in the old testament are all contain in the myth,legends,history of ancient Egypt.if Htler hated the jews,he hated them for the wrong reason