The Federal Government exceeded its 2023 debt service budget by N869.38 billion in nine months.

This is according to the Breakdown & highlights of the 2024 executive budget proposal presentation document by the Minister of Budget and Economic Planning, Abubakar Atiku Bagudu.

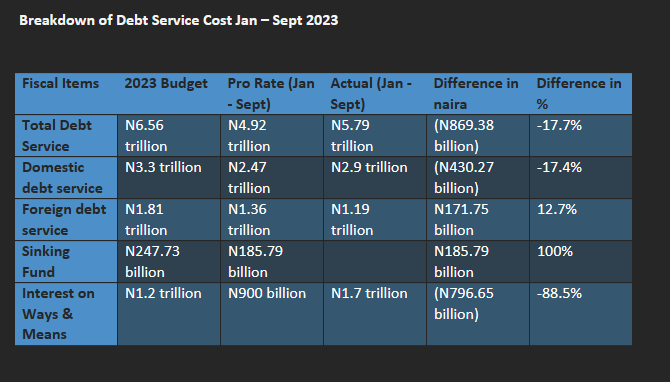

A copy of the document obtained by Nairametrics shows that the Federal Government planned to spend N6.56 trillion on debt servicing in 2023.

It is expected that between January and September, the Federal Government should have spent about N4.92 trillion on servicing debts.

However, it ended up spending N5.79 trillion in the first nine months of this year, which is higher than its debt service budget for that period.

An analysis by Nairametrics shows that the excess debt service spending was mainly due to domestic debt service and interest payments on borrowing from the Central Bank of Nigeria (CBN) through the Ways and Means Advances.

Debt service cost overwhelms capital budget spending

While the Federal Government spent N5.79 trillion on debt servicing in the first nine months of this year, it only spent N1.47 trillion on capital expenditure.

This means that spending on debt is almost four times more than what was spent in infrastructural projects in the country despite the huge infrastructure deficit.

It was also observed that the Federal Government fell short its capital spending budget by 75.3%.

Regarding this, the document read:

- “Only about N1.47 trillion (25% of the pro-rata budget) has been released for MDAs’ capital expenditure as of September 2023.

- “This level of performance is partly explained by the introduction of the ‘Bottom-up Cash Plan’ arrangement with effect from 2023.”

The goal of the Bottom-up Cash Plan is to improve the execution of the capital budget by having government agencies generate monthly cash requirements according to their actual needs instead of getting predetermined allocations.

FG spends 66.93% of revenue on debt servicing

Nairametrics also observed that the Federal Government spent about 66.93% of its revenue in servicing debt within the first nine months of 2023.

This is an improvement from the past when debt service usually gulped over 90% of government revenue.

The reason for the improvement was due to the revenue boost from the recent policy reforms, such as fuel subsidy removal and forex unification.

The Federal Government exceeded its revenue target by N369.62 billion within nine months.

The Director-General of the Debt Management Office, Ms. Patience Oniha, in an interview with Bloomberg recently stated that the Federal government’s efforts to enhance revenue are expected to cut its debt-service ratio by 20% in the medium-term.

More Insight

DMO recently expressed concern about the 73.5% projected government debt service-to-revenue ratio in 2023, adding that it will be a substantial threat to debt sustainability.

It was stated that the government’s present revenue structure cannot sustain an increase in the level of borrowing.

Also, the International Monetary Fund (IMF) said the Federal Government is forecasting that a substantial 82% of its revenue will be used for interest payments in 2023.

In addition, the World Bank’s outlook for 2023 showed that debt servicing would gulp an alarming 123.4% of the Federal Government’s revenue in 2023.

However, President Bola Tinubu said the country could not continue to service its debt with 90% of its revenue, adding that doing that would lead the country to destruction.