Nairametrics| The Central Bank of Nigeria quarterly Treasury Bills Issuance Calendar is released to the public periodically as a guide for investors to know when they can bid at the primary market for treasury bills purchase.

If you are interested in knowing when the next treasury bills auction will take place, then mark these dates as they fall due. This page is updated quarterly as the CBN updates its calendar issuance dates.

You can also see dates of previous issuances in the images below.

See below:

4th Quarter of 2018

3rd Quarter of 2018

2nd Quarter of 2018

1st Quarter of 2018

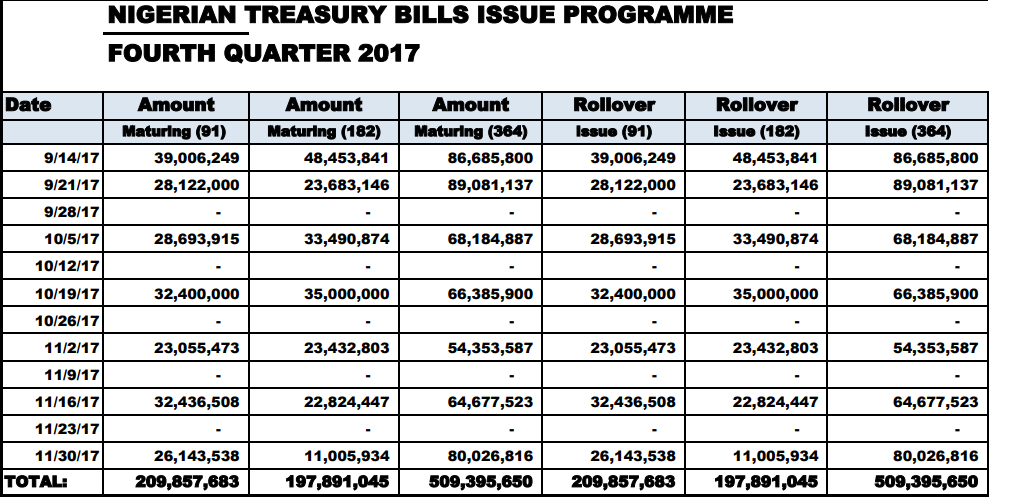

4th Quarter of 2017

3rd Quarter of 2017

2nd Quarter of 2017

First Quarter of 2017

Are you saying I can still buy treasury bills even if I do not have up to #50,001,000 through the banks with the new CBN policy?

Via the secondary market

which is the secondary market?

Can I invest in treasure bill a day before the auction date

Yes you can

Although I am waiting for the maturity to see what amount will be paid back to me. I invested 250k for a91day TBILL but got a credit alert of 435.47naira for upfront interest payment meanwhile the rate was at 13.50%as at Mar 17, 2017.

probably its on rollover that is why you are getting that amount

Are you sure you bought treasury bill? You may probably be running fixed deposit. Treasury bill has the following characteristic.

– Interest is paid upfront (don’t yield interest)

– Tender is between Monday to Wednesday, issue and payment on Thursdays 1:30pm

– Zero tax on interest

– Short time maturity

– Use as collateral.

If you fixed 250,000,000 at 9% for 91 tenor, your interest a day will be (N250,000* 9/100/365)

= 61.64, for 91 days is N5609.59 but will be paid monthly amounting to N467.47 with a withholding tax of 10%. Your net interest is N 420.72.

Thats a bonus on your investement, your interest had been added to your investment so you are getting your principal and interest at maturity

whats the problem with the above question

It is Treasury Bill . the alert you got is the balance on the roll over ( Principal +Interest) which is not up to N1000

What do the mean by roll over?

Please I have a question. If am.investing 10 million in TB and I want to invest both principle and interest . How will.this be calculated or will the interest be calculated separately or will be invested at the same time with the 10million

when you invest 10m in TB, the interest will be paid upfront (which means your deal amount will be less than 10m), but you can invest right back the interest paid upfront (capitalizing interest), then it will mean you are investing the 10million as the deal amount, then the effective yield will be used to calculate your total interest at maturity.

When is the auction for treasury bills in September 2017?

If I invest 2m on 91days tenor treasury bill what will be my interest and when will it be paid.

Assuming an interest rate of 16% you will get N80,000. That is, 16% multiplied by N2m multiplied by 91 all divided by 364.

Pls I want in invest now on treasury bills. Advise me on what to do and what is rollover.

Can I invest N8,000,000.00 for 3 years in TB? Can I can get 19% to 20% interest? What will the payout to me be at investment?

When is the auction for treasury bills in September 2017 ?

When is the auction for treasury bills in September or October 2017 ?how does cbn release tb to bank?monthly or quarterly

Was GTbank successful in the 364-day CBN treasury bill bid for any of the auctions in September or October?

Can someone tell me GTbank was successful in any of the CBN 364-day treasury bill auctions for Sept 2017 and October 2017

Is The treasury bill rate different bank by bank or its the same rate in all bank. I invested 2M and 21/9 and was given a rate of 13%.

Whethwhat are the requirements for buying a treasury bill? I want buy 2millon naira bill if i can get it at 20% rate and a tenor of 91 days but just have current and savings accounts with some banks

What is the minimum amount allowed to buy tb

Can I invest #500,000 in treasury bill, and how much will i get in return? pls.

Should I buy a t.bill of 100,000 say 91 days ..what will be my added interest.

what was the rate for a six month tenor at the 3/11/17 sells

Can someone help confirm if GTbank was successful in the September 2017 and early October 2017 364-day T.bill offer by the CBN. I feel my account officer lied to me stating that the bank was unsuccessful in 3 consecutive bids

big lie

ple i want to invest 1million naira on treasury bill. whats the last rate and what will be my interest, pls advice.

i wish some of the above questions will be answered.

hi

Pls when is d next auction treasury bill in February…. If I invest 1m in 3month Wat WI be my interest. Thanks

No response to my request pls.

PLS HOW MUCH IS TREASURY BILLS OF 5M IN 364DAYS IN GTBANKS % AND THE AMOUNG

Can someone invest five hundred thousand naira on treasury bill?

Yes you can

How?

You buy from the secondary market but via a bank.

can you please explain to me, because i do not actually understand how this TB % works, i just invested 28M for 91 days and i just got a credit alert of 767,890 thousand naira saying my Discount on TB, does that mean thats my % gain ?.

From our calculation, your interest gain was 10.9% on the N28 million for a period of 91 days. To check simply multiply 10.96% X 28 million X 91 all divided by 364. It is also likely that the bank would have charged you a nominal fee.

@VER, Please, I am about to make a decision to either invest my 30M in TB or on a house in Ajah. Question 1 is, your credit alert of 767,890 thousand Naira, was it credited to you the same-day you filled the form to invest the 28M for a 91-day period?? To my understanding, it is your calculated gain after your bank has taken out their own fee. Different banks have their respective fee to process this service, Question 2 is, what bank are you with?

07064437340 Kingsley Pius

C.E.O, Event Planning Business / Real-Estate Investor

Yes, this is the actual amount credited to my account, 767,890 that is after my bank debited 7,600 as charges for initiating TB, I am banking with zenith

What is the interest rate now

Pls the 91days treasury bill package is it 91days of a calender year?

Pls the 91 days treasury bill package is it 91 days of a calender yea

Pls i did treasury bill of 91days on 15th of Febuary 2018, When am i going to collect the capital, someone should pls help.Thanks

Hi. If I invested N5M in TB of 91 days and sometime during the cycle, I need to withdraw N1M from the principal amount, is this possible?

I was to do tb of 1m in zenith back for 364 days. How much will I get back?

Hey guys if i invest 1M for 90 days. What will my interest be per month. Someone please help analyse this. Thanks.

Hello Spazzo!

Your interest rate will be detertmined by the kind of investment you venture into and the rule of operation between the parties concerned.

Please is there no TB sales for month of July ?? going by the calender, will they be a sales of TB ?

This has now been updated. Kindly check the website again.

@admin Please is they going to be a tb sales for the month of July ?

The calendar has been updated. Kindly check the website again.

I was at zenith bank as early as 9am today Wednesday and they told me the portal for tb has closed. i find this abnormal since tomorrow is the deal day for TB

Can i invest in USD and yield my interest in USD?

Please who can coach me on this treasury bills? how does it work? how are they making money from it?

I want to invest N500k in Tbill can i do this through my bank? if not i will appreciate a step by step guide on how to go about this.

Please admin, can I do treasury bill with Sterlin bank ?

Yes you can via the I-Invest app https://bit.ly/i-invest_ng