Teleology Holdings has moved one step closer to taking over embattled GSM operator 9Mobile. Reports by Thisday, state the company has paid the $50 million non-refundable deposit (Thisday seems to get all the scoops on Teleology).

According to the report, Adrian Wood, a key promoter at Teleology revealed the progress that has been made so far and plans going forward for the telco. Teleology is expected to pay $500 million balance.

Good news for the banks

Adrian Wood, who will take over as Chief Executive Officer (CEO) also confirmed that the firm had signed a Loan Purchase Agreement. This means Teleology will take over the repayment of the loan.

With the execution of the Loan Purchase Agreement, Teleology will take over the loans of the 13 banks from 9mobile in exchange for a payment plan.This means that 9mobile will have no loans on its books and no longer owes the banks since Teleology has assumed the loans.

Leverage buyout?

Wood also disclosed that half of the loan will be repaid after its takeover of 9Mobile and the rest in tranches. This suggests this might be a leverage buyout type takeover. Leverage Buyouts occurs when an investor acquires a target using debt funding, loads the debt on the target’s balance sheet and using the cash flows from the target to repay the debts.

It is not entirely allowed in Nigeria, however, there are ways of achieving this. To do this, the strategic investor leaves the loans on its own balance sheet but uses the cash from the target company (acquired entity) to repay the loan. The acquired company then records the cash collected from its revenues as an intercompany loan against its parent company.

This structure often times kicks the can down the road as it relies solely on cost-cutting and better operational efficiency to squeeze out cash from the acquired company. The objective is to build up equity valuation ahead of an eventually raise which will now be used to pay down the debt. However, if things go south, sooner than they raise equity, the problems we had in the former Etisalat might resurface.

How did Teleology raise funds?

Funds for the takeover are being provided by Afrexim Bank and UBS. UBS is sourcing funds from a consortium of local and foreign banks.

As earlier mention, this suggests that Teleology has no equity, and would be relying on 9Mobile’s cash flows to service the debt. This could be a worthwhile strategy if this was a prequel to an equity raise. For the Nigerian banks involved, this would be a means of spreading risk.

Who is behind Teleology?

Perhaps to assuage fears the company was a shell corporation incorporated, Woods also stated that Teleology’s shareholders would be revealed after the takeover had been concluded. Several of them are Nigerians.

Going Forward

Concerning management, Woods also mentioned that several of his ex-colleagues at MTN would come on board.

“We have 12 executives coming in and they comprise five of my former colleagues at MTN such as the ex-CTO and ex-CFO. Others include executives from Orange, Vodafone, Celtel and others.”

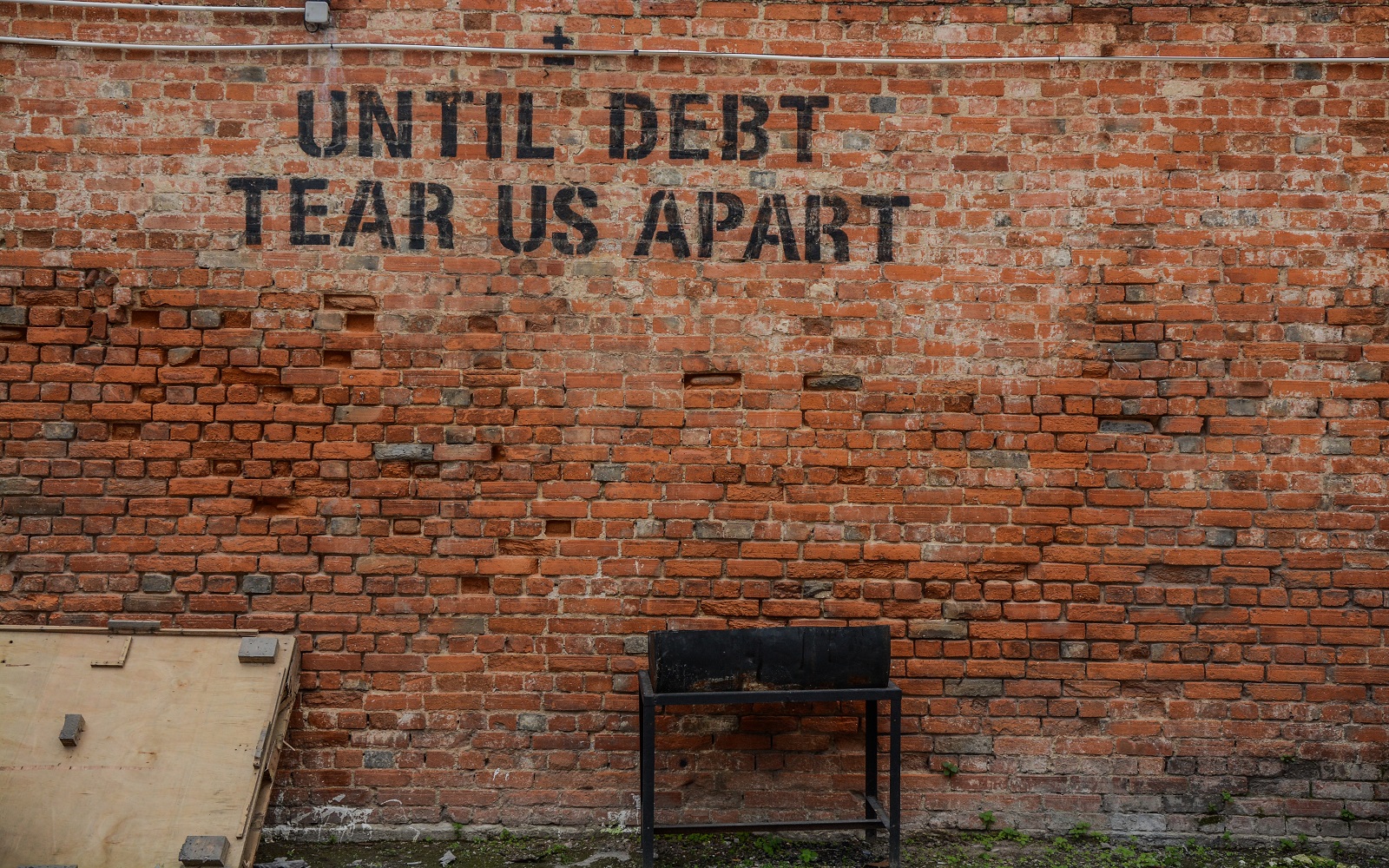

9Mobile’s (then known as Etisalat Nigeria) woes began when it defaulted on a $1.2 billion loan provided by a consortium of Nigerian Banks. Parent company Etisalat of the UAE exited the firm, and the banks threatened to take over.

They were however restrained by the Nigerian Communications Commission and the Central Bank of Nigeria (CBN), which formed an interim board. Some of the affected banks have since made provisions on the loan.

Barclays Africa then midwifed a bidding process for Etisalat of the UAE’s stake. This has however had some of the controversies as some of the bidders alleged the process was filled with irregularities. Parties familiar with the bid process, however, denied this.