Offshore Selloff, Weak Local Demand Drive Bond Yields Higher

Manufacturing PMI Expands for Fifteenth Consecutive Month in June 2018 – CBN

Bonds

The bond market traded on a significantly bearish note, with yields rising sharply by c.30bps following significant offshore selloff on the medium to long end of the curve. We witnessed a sharp drop in bid prices due to risk off sentiments and weak demand amongst the local market players. We expect bond yields to remain pressured as we get into the second half of the year. This is largely due to expectations of heightened political risks ahead of the forthcoming elections, increased FGN borrowings for budget funding and risk off sentiments by offshore investors on EM bonds.

Treasury Bills

The T-bills market traded on a relatively flat note, with yields compressing marginally by c.5bps on average. This was as the CBN left system liquidity relatively stable, following the lack of an OMO auction in the previous session. We however note that system liquidity has been gradually depleted over the course of the week, following significant FX interventions by the CBN in the Interbank and I&E market, to meet demand mostly from exiting FPIs. Barring a continued drain in system liquidity, we expect inflows from FAAC disbursements in the coming week to moderate funding pressures and consequently spur some buying interests in the T-bill space.

Money Market

The OBB and OVN rates declined slightly to 13.17% and 14.08%, as there were no significant funding pressures in the system. System liquidity however posted a decline down to c.N100bn from c.N190bn in the previous session. We expect rates to trend slightly higher opening next week. This is unless we have early inflows from expected FAAC payments hit the system.

FX Market

The Interbank rate remained stable at its previous rate of N305.75/$. The I&E FX rate also remained relatively stable at N361.32/$. In the parallel market, cash and transfer rates remained stable at N360.00/$ and N364.00/$ respectively.

Eurobonds:

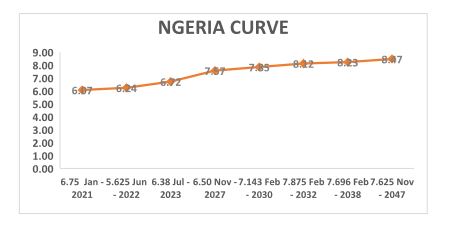

The NGERIA Sovereigns traded on a relatively flat note, with yields compressing marginally by c.1bp. We witnessed slight buying interests across the curve, except for the 21s which rose by c.2bps (-0.05pt).

The NGERIA Corps were mostly bearish, with investors selling off mostly on the ACCESS 21s Snr, FIDBAN 22s and SEPLLN 23s. We however witnessed strong buying interests on the ZENITH 22s and on the shorter ZENITH and DIAMBK 19s.