Nigeria: IMF Raises Nigeria’s 2019 Growth Forecast to 2.3%

KEY INDICATORS

Bonds

Yields in the bonds market weakened today, with yields expanding by c.0.02bps on the average across the curve. Market participants remain uncertain on a clear direction of yields, with slight sell-off pressures witnessed on the long end of the curve. We expect the risk-off sentiments to prevail in the interim, as the market factors in various variables in determining a clear direction of yields.

Treasury Bills

In contrast to the bonds market, activities in the T-bills market remain bullish supported by buoyant system liquidity and demand from investors looking to reinvest bond coupon payments in the interim as yields continue to adjust to local and international headwinds. Discount rates compressed by c.24bps across the trading benchmark securities, with majority of the demand witnessed on the short to medium end of the curve. We expect this trend to continue in the interim, barring any liquidity management action by the Central Bank.

The Debt Management Office (DMO) is expected to rollover N5.85bn, N26.60bn and N145.96bn of the 91-, 182- and 364-day bills respectively at the primary auction scheduled for tomorrow. We expect the stop rates to close lower than the previous auction, as system liquidity continues to support investor demand for treasury bills.

Money Market

Rates in the interbank money markets dropped further amidst buoyant liquidity and reduced funding pressures on market participants. The overnight (O/N) and Open Buy-Back (OBB) rates closed at 7.50% and 8.58%, in line with the theme of the week.

Our expectations for low interbank rates remain as inflows from bond coupon payments (N34.71bn) are expected to hit the system from tomorrow.

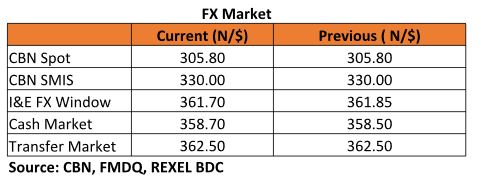

FX Market

Still no volatility witnessed on the Naira, as the CBN continued its weekly FX sales to meet consumer demand for the greenback. The Naira remained relatively stable, with the Interbank rate closing flat at N305.80/$ for the fourth day in a row. The NAFEX rate appreciated slightly by 15k, closing at N361.70/$ (c.0.04% up from N361.85/$ previously).

Rates in the parallel market closed the week on a flat note as USD cash and transfer rates closed at N358.70/$ and N362.50/$ respectively.

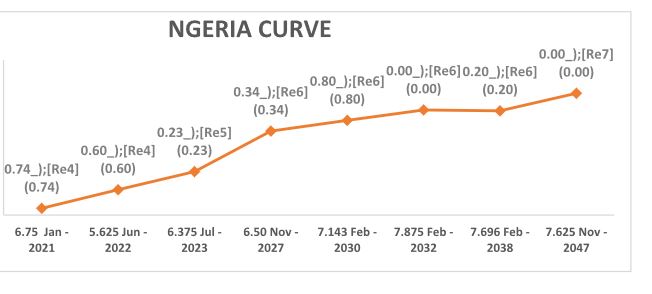

Eurobonds:

Pressures from falling oil prices globally resulted in risk-off sentiments on NGERIA Sovereigns by investors. Yields across the traded tickets expanded by c.13bps on the average.

Yields on NGERIA Corps on the other hand compressed by an average of c.02bps across the curve, with pockets of demand interests witnessed on the DIAMBK 19s.