This is a short account of the activities that underpinned Dangote Flour Mills’ remarkable 288% share price rally in 2016. The precursor to this, was Tiger Brands’ disastrous investment in a couple of Nigerian FMCG companies.

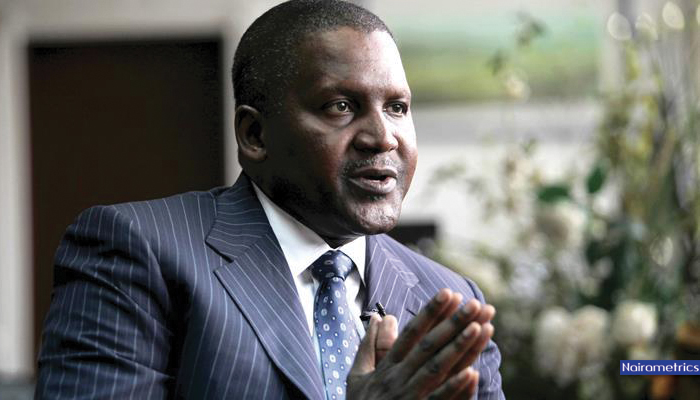

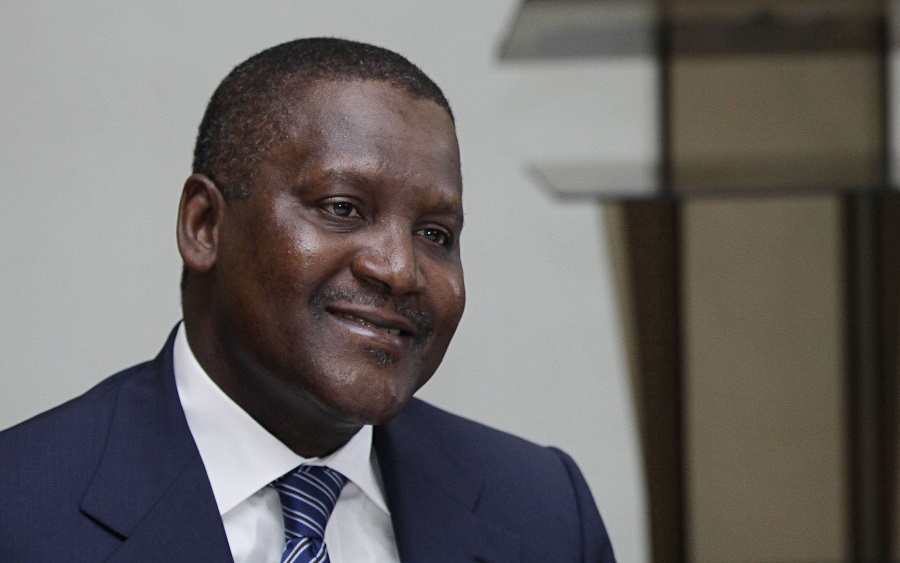

Sometime in 2012 a South African Company named Tiger Brands decided to acquire Dangote Flour Mills from Alhaji Aliko Dangote. The company was performing poorly at the time.

The acquisition cost Tiger Brands about $182 million for 63% of the company. In 2013, they increased their stake to 70%, effectively becoming the owners of the company. The stock was trading at around N9.

After the acquisition, the owners implemented a series of strategies geared towards reversing the fortunes of the company. But things only went from bad to worse. By the end of 2013 the company’s losses ballooned to N7.2 billion. It reported 6.1 billion loss in 2013.

what went wrong?

so what exactly happened? This write up is incomplete.

The gist in incomplete. How did DIL turn the fortunes of the company around?