Remember when they told us that commodities were such a wonderful asset class, great store of value and hedge against debasing currencies…LOL! Commodities have done nothing else this year than fall! The Bloomberg Commodity Index (aggregate of a number of metals and commodities) has fallen more than the Nigerian All Share Index Year-To-Date (now that’ bad!).

A Picture, they say is worth a thousand words. So, let’s go through the one year charts of some of the major commodities. (All charts courtesy of TowerGlobalfx )

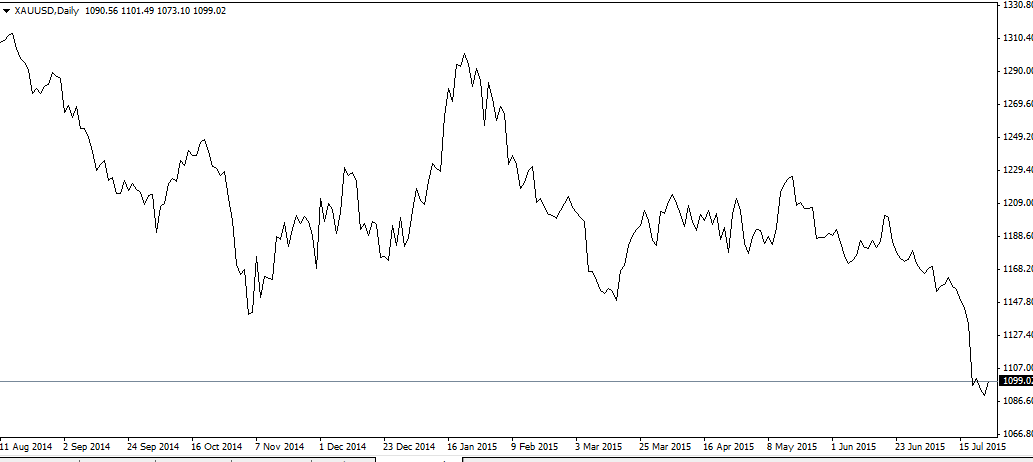

Here’s Gold

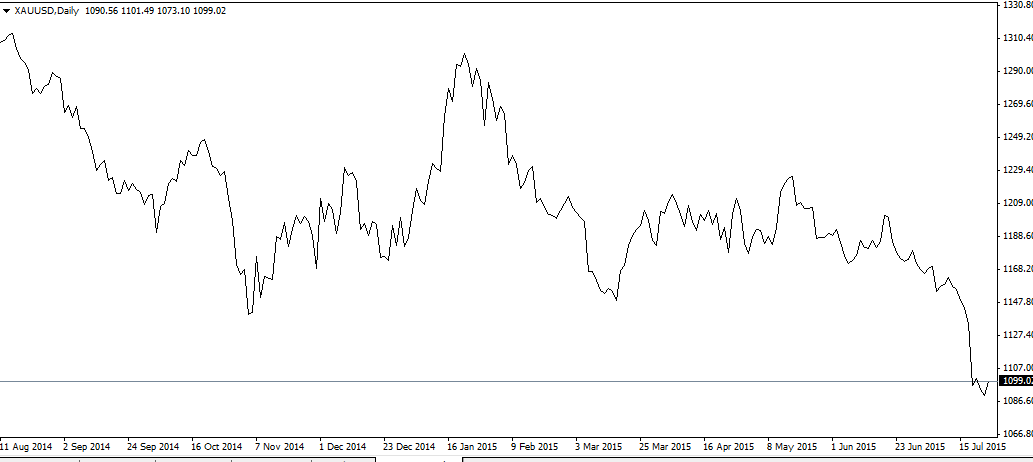

Silver,

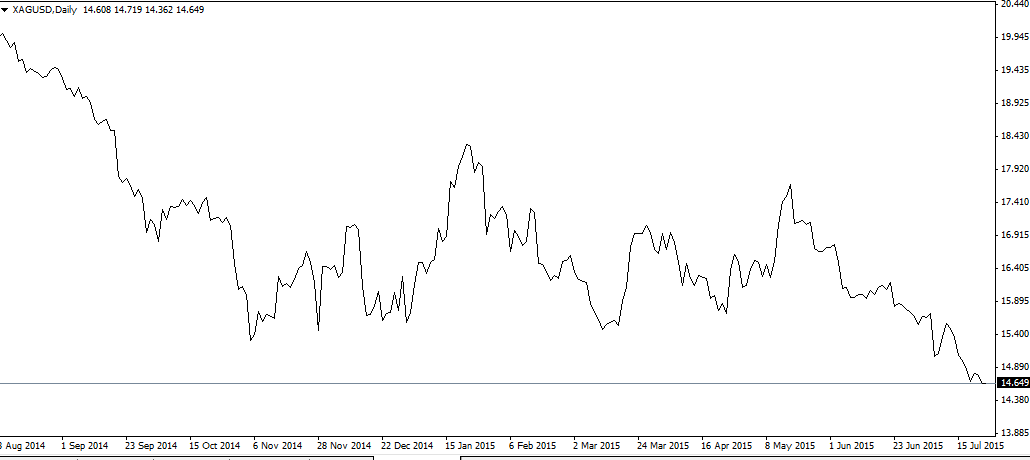

Platinum,

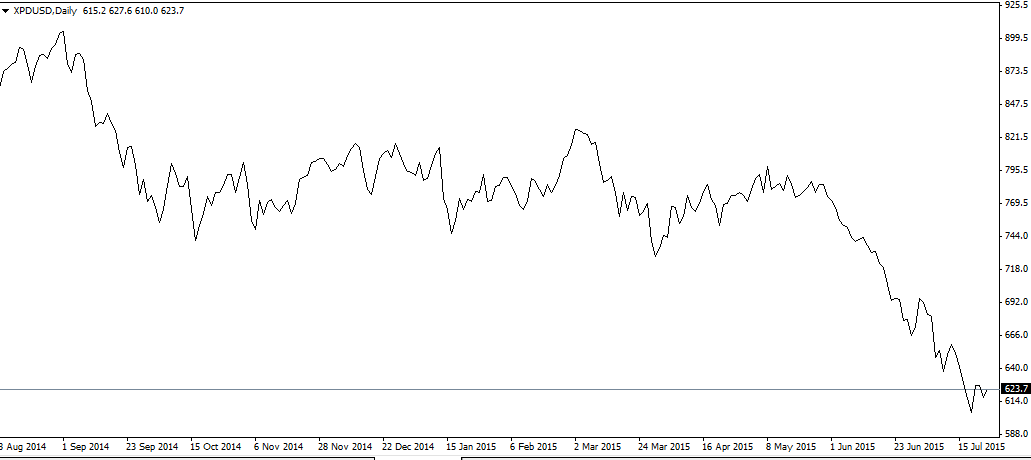

Palladium,

And Nigeria’s favourite buddy- Brent Crude Oil

Gold made a new 5.5 year low so if you happened to have bought Gold and held it for the last 5 years, you would currently be at a loss. The best investment play over the last year in the commodity space was not to be long global commodities but short global commodities (short positions are investment positions that benefit from the fall of an asset).

So is it too late to short commodities in general? Is the decline over? That’s a billion dollar question! The truth is that nobody knows. Commodities usually take long periods (months to even decades) to bottom out, so buying commodities in the hope of a reversal may not be a good play now.

However, if you are like me- a believer in the concept of momentum in the financial markets and think commodities could still fall further, I suggest you execute this idea through a short position in copper.

Here is a weekly chart of Copper- No question- the trend is down

Observe the $2.38 price level (where the horizontal line is). Price tested that level in late 2014 before copper experienced a reversal to the upside. Now Price is currently at that same price level. The daily chart of copper (below) shows more clearly price action around the $2.38 level

Our trade ide is simple: As long as copper prices are below $2.38, we would take short positions with a target of $2.08. Our risk is also well defined- if price closes above $2.38, the investment idea would be invalidated and we will have to exit at a small loss.

Good duck with Trading!

Disclaimer: I am currently short on Platinum for my personal account. The ideas presented above are for information purposes only.

![[ANALYSIS] Despite the Commodity Rout Can We Still Get In?](https://nairametrics.com/wp-content/uploads/2015/07/Commodity.jpg)