Nairametrics| Stanbic IBTC Absolute Fund made an 11.5% return for the year ended Dec. 31 2016 and its asset increased by almost a corresponding percentage to N5.33 billion. This information comes from analysis by Quantitative Financial Analytics Ltd, Nigeria’s foremost mutual and pension funds analytics platform.

The return however under-performs its 2015 performance of 13.19% but it brings its cumulative or inception to date (ITD) return to 60.73%. This implies that investors who bought into the fund at its IPO price of N1,500 would have gained N910.9 per unit of the fund as at Dec 31, 2016

According to Quantitative Financial Analytics, IBTC Absolute Fund has been one of, if not the most consistent mutual fund in Nigeria in terms of performance. Since January 2013 when Quantitative Analytics started tracking the fund, Stanbic IBTC Absolute Fund has made positive returns month after month except in June 2013 when it recorded a forgivable 0.58% negative gain. The fund made a return of 10.71% in 2013, 12.62% in 2014 and 13.19% in 2015.

The fund which suffered a net outflow of about N13.9 million in 2016 generated an estimated gain of N687.5 million in 2016 to take its total NAV from its 2015 ending balance of N4.78 billion to N5.33 billion. It is now the 7th largest mutual fund by assets in Nigeria.

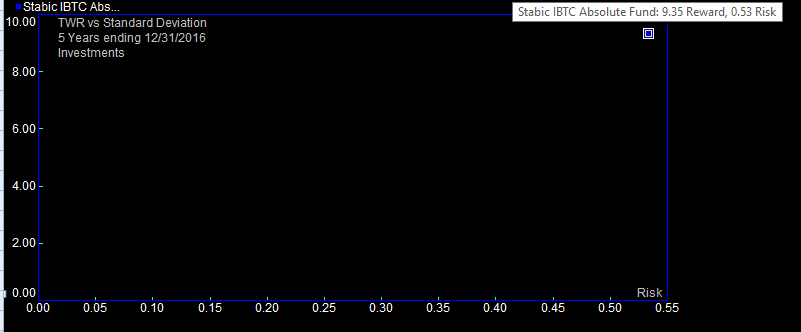

The risk return profile of the fund is also very appetizing in that it has a return of 9.35 and risk of 0.53 making it a low risk medium return fund.

IBTC Absolute Fund has a negative correlation of 0.14 to the Nigerian stock market and a Beta of -.01, a Sharpe ratio of -2.27 and R-Squared of .02. All these statistics point to the fact that the fund is relatively “immune” from the vagaries of the stock market.

The fund is a member of the Stanbic IBTC Umbrella funds which includes the Stanbic IBTC Conservative and Stanbic IBTC Aggressive funds. The investment objective of the Stanbic IBTC Absolute fund is to ensure preservation of capital with minimal risk. Looking at the risk return profile, it does look like the fund’s objective is being realized. The target asset allocation of the Fund is limited to fixed income securities. The Fund therefore invests 100% of its AUM in Fixed Income securities and is aimed at holding a portfolio of securities with little or no volatility in returns. The fund was debuted at an IPO price of N1,500 and currently trades at N2,487.92

Disclosures: The author or anyone in Quantitative Financial Analytics has no investment in Stanbic IBTC Absolute Fund or any fund managed by Stanbic IBTC Asset Management and we were not paid for this piece. It is also instructive to note that past performances do not guarantee future performances.