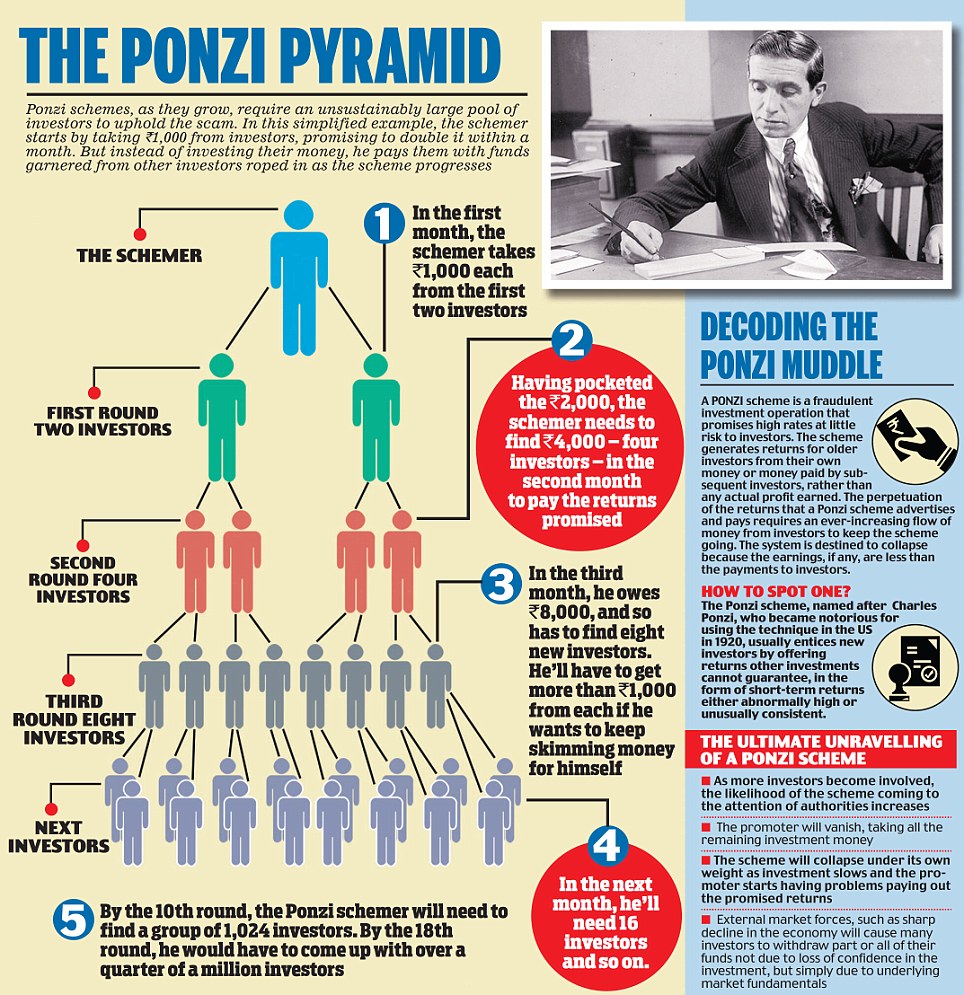

A Ponzi scheme by definition is a version of fraud that rewards early investors with massive returns from the cash invested by newer investors. Ponzi schemes typically do not have underlying assets or enterprises upon which the investments are built, rather cash payouts are sustained from the contributions of investors who come later.

In this article, we will provide tips on how you can determine if you are about to invest in a Ponzi scheme or not.

The returns are astronomic

One of the most notable elements of a Ponzi scheme is that the returns investors get are astronomically high. A typical Ponzi scheme pays early investors as high as 20% monthly in returns. Based on this, perpetrators of Ponzi schemes promise early investors very high returns in the hope that the early investors will spread the “good news”, thereby inviting more contributors to the scheme. Once new contributors join the scheme, their money would be used to pay out high returns to older investors. Of course, investors/contributors to the scheme really do not care, so far they continue to get their returns along with the capital.

Returns are consistently high and steady

It’s almost impossible to see a business that guarantees the same return, come rain or sunshine. When someone tells you he will pay you 20% or 30% return monthly consistently and doesn’t break that promise, that should start to give you a cause for concern. It’s a bit ironic as no one expects not to be paid a return when they invest. But there are ups and downs in every business such that even if they do not post losses, the returns cannot continue to remain stable. If you do not see a bit of fluctuation, then you should start to ask questions. Investment schemes often invest their money in businesses or financial products which are often prone to the risks of an economic downturn, exchange rate fluctuation, inflation, etc. Anyone, who guarantees a steady payment of excessively high returns could be operating a Ponzi without you knowing.

No underlying asset or business

Ponzi schemes by nature do not have any underlying asset that the money is invested in. If you ask them what they use the money for, most early investors will usually sound discordant tunes. They speculate and can’t point specifically to what the money is used for. The reason for this, of course, is because there is hardly any business that pays as much as 20% in monthly returns, and so when they mention the business, you can easily deduce if it’s real or not. Ponzi creators know this is a problem and often come up with very grandiose business models that are often difficult to explain clearly.

They are not recognised by regulators

Ponzi schemes are also not recognised by regulators. Unlike most investment schemes such as mutual funds, pension funds, ETF’s etc., which are all recognised and regulated by the Security and Exchange Commission (SEC), Ponzi schemes do not have such oversight. As such, investors do not have any form of recourse, exposing them to the risk of losing their entire investment when the Ponzis collapse. When Ponzi schemes collapse, the bank balances are frozen completely.

It relies on new members to sustain the scheme

As mentioned above, Ponzis rely a lot on new members to sustain the model. That is the only way they can guarantee the consistent returns we mentioned above. Once the rate of growth of new members start to plummet, the likelihood of the Ponzi collapsing gets higher. Agreed, there are other business models out there that rely on new investors to grow but they are tightly regulated and the funds are tied to specific investments. Cooperatives, for example, are a bit like that which is why they are recognised by law and managed by a recognised governing board. Ponzis bear no such hallmarks.

It is often impossible to determine the asset value

Mutual funds, pension funds, ETF and even cooperatives all have asset values, known to contributors. You should be wary when you are approached to invest in a scheme and the perpetrators cannot show you the asset value of the scheme.

It relies on people’s greed and thirst for quick money

Whenever you see a business that attracts all and sundry, it typically has greed as the common thread. Everybody is a willing participant because of the greed for earning astronomical returns over a short period of time. Ponzi schemes attract all types of investors. From novices to savvy investors, rich and poor, everyone is looking to cash in.

Owners/creators of the scheme hardly advertise. They rely on word of mouth to spread the “good news”

Word of mouth is perhaps the most common selling point for Ponzis. They hardly advertise because, like we earlier stated, they cannot clearly explain what they are doing with their money. Most investment schemes such as mutual funds or pension funds, often advertise on TV, radio or in the pages of newspapers and will also offer prospectus detailing what they intend to invest your money in and what sort of returns to expect. They also clearly spell out the risks involved and the recourse in case the businesses goes bad. Ponzis have no such structure, so they rely on word of mouth and high returns to draw innocent investors in.

So, if you see a business that bears these hallmarks, try to apply extra due diligence and caution before investing your money.

Source: Daily Mail

This article was first published on Nairametrics on September 17, 2016.

if they dont sell a product or proivde a service then its a scam, full stop

Nice article..

Please correct the fourth point: “They are not recognized my regulators” should be “They are not recognized by regulators”

You can remove this comment too..

Is Boonbuy Network a Scam ?

Hi Admin, any idea if porkmoney.com and their returns are legit i.e. not a ponzi scheme