Money market funds in Nigeria suffered an estimated N4bn of net outflows in the week that ended on April 15th as confidence in their safe-haven status weakened following the current low interest rate regime of the Central Bank. The outflows signify a new and potentially dangerous phase for the N177bn money market fund industry as continued redemptions undermine the required and anticipated growth in the mutual fund industry. This is ominous for the entire mutual fund industry because much of the mutual fund assets are held in money market funds so much such that, if the money market funds sneeze, the entire mutual fund space in Nigeria could catch fever.

Source: Quantitative Financial Analytics/SEC

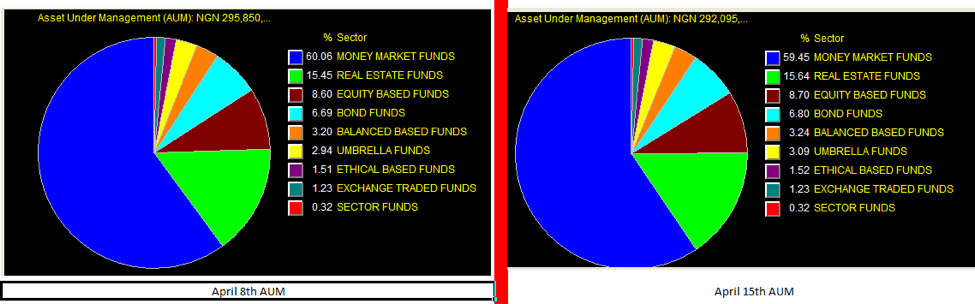

Money market funds had accounted for 60.06% of total mutual fund assets for the week ending on April 8, but the latest data shows that 59.45% of the N292bn industry is accounted for by money market funds. Though the change looks small, it could portend a disconcerting trend if it continues.

Historically or since Quantitative Financial Analytics began tracking Nigeria mutual funds, money market funds have had huge inflows week after week. This year alone, money market funds have had an estimated N40bn inflows and N 15.7bn outflows resulting in a net flow of N24.3bn. Compared to the whole mutual fund inflow of N48.6bn, outflow of N19.15bn and resulting net flow of N29.4bn

The single biggest outflow (for the week ending April 15) was from Arm Money Market Fund which saw N1.68bn of outflow followed by Stanbic IBTC Money Market Fund’s N1.57bn outflow. Total industry net outflows for the week added up to N4.09bn. By the end of the week in question, total mutual fund asset stood at N292.09bn from its previous week value of N295.85bn

Investors have viewed money market funds as safe haven especially in an era when the stock market is increasingly erratic and volatile. Though yield is generally low, but recent data indicate that they are slightly inching up, so it is surprising why investors decided to pull back on their money market fund investments. The Bond Auction on April 13th where successful bids for the 15.54%FGN FEB 2020, 12.50% FGN JAN 2026 and 12.40% FGN MAR 2036 were allotted at the Marginal Rates of 12.0000%, 12.6000% and 13.0800%, respectively, could explain this surprise. May be, investors are becoming more favorably disposed to the longer end of the yield curve and the higher yield that comes with it compared to the prevailing money market fund yields. We are watching this trend

- Please note that the flow numbers are estimates made by Quantitative Financial Analytics based on data released by the SEC

About Quantitative Financial Analytics:

Quantitative Financial Analytics is a group of financial analysts eagle-eyed on Nigerian funds (Mutual, Pension, Fixed Income Securities) with the mission to add tranperency and timely reporting to the fund industry. They can be reached at www.mutualfundsnigeria.com