The economy could now be set to face another major headwind – falling aggregate spending by households or consumers in the economy. And this is no farce; there is data to prove it.

Consumer and household spending is crucial because it is the largest component of GDP. It holds up the other sectors in the economy, especially the business sector. If it drops, aggregate output and employment will also drop, and the economy will stagnate or even start to decline.

Consumer spending in the economy has been on the decline since the turn of this year as a result of various adverse factors, (including persistent rise in inflation), that have affected consumers’ purchasing power. It has also been on the decline because household incomes are falling too. The trend is made worse by the non-payment of the wages of public sector workers.

It is not clear which of the two factors is the causative one, but they affect each other mutually.

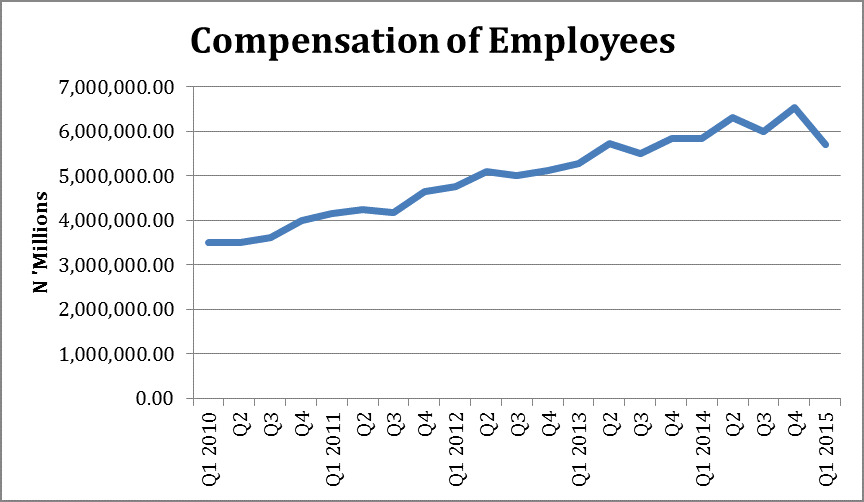

Compensation of Employees (COE) slowed in Q1 2015, declining sharply by 9.99%.

Source NBS

This trend is dangerous because Nigeria is basically a consumption driven economy. Household consumption and spending accounts for 64% of the country’s GDP. If consumption dips, it will drag every other sector down with it, including businesses and investments.

It could be worse if the trend persists for longer, as the economy could find itself in a downward spiral if measures to stimulate the economy do not show up in time.

The downward spiral will result from the fact firms will record lower sales and lower profits as consumers cut their spending. This will consequently lead to a further cut in household salaries and income as the firms try to cut costs and improve margins. This will then also lead a cutting of more spending by consumers, which will lead to even lesser sales by firms. The cycle is vicious.

According to basic economics, in situations like this, firms will reduce the prices of their goods to stimulate demand. But they can’t in this case because costs are structurally high – mostly due to energy costs and forex.

Although the fear of a recession is still uncalled for, it is not unfathomable, especially if the government continues to dither in setting out economic policies, and easing the flow of capital to stimulate investment spending, which will boost the economy. Dithering will elongate the negative trend.

The events that led to the economic downturn is not the new administration’s fault, but Buhari’s economic silence and delay is making matters worse.

The reasons why this isn’t a recession yet is because Nigeria’s economic growth is not yet in negative territory, and the trend is just starting out. Some indicators are also yet to ‘click’. A recession is two consecutive quarters of negative economic growth.

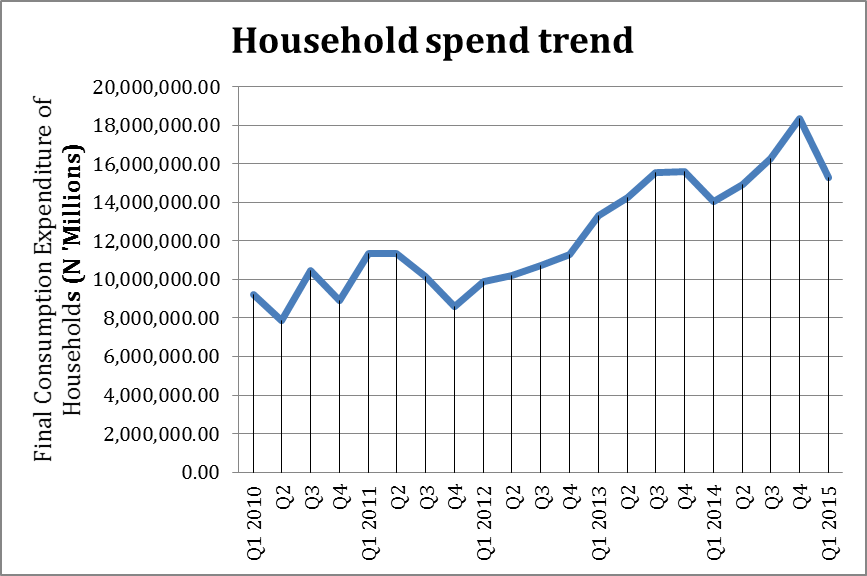

Data from the NBS

Consumer spending has fallen by a massive 10% this quarter.

Quarterly Gross Domestic Product (GDP) using the expenditure approach provides a picture of the current economic status of the economy.

According to the NBS, in real terms the final consumption expenditure of households plunged by a whooping 10.6% from last quarter of 2014. Tied to it, Compensation of Employees (COE) slowed in Q1 2015, declining by 9.99% in real terms.

As a sign that this is already affecting business investment in the economy, Gross Fixed Capital Formation (Investment) component of GDP grew at a slower rate. Year on year growth in investment was recorded at 9.72% percent in real terms, down from 20%, and 12% recorded in Q1 and Q4 of 2014 respectively.

In Q1 2015, 7 out of 10 surveyed FMCG firms recorded negative growth in profit after tax. On the average, the FMCG industry’s PAT shrunk by about 40%.

Net Exports have also declined by 36% year on year.

A report by research form SB Morgen Intel said last week that the average Nigerian not well placed to financially cope with increasing commodity prices, and that prices could rise further, which seem plausible given the way the FX situation is being handled.

Hence consumption could fall even further.

Rising prices of essential commodities will cause consumers to cut spending on less essential items – things that are considered as not absolutely essential.

According SB Morgen’s estimates, the average Nigerian worker already spends about 60% of earnings on feeding.

One sure thing is that this negative trend is going to continue into the next quarter.