- Nigerian Breweries Plc (NB) released audited financial results for the full year ended 31st December 2014, wherein revenues were flat (-0.8% YoY) from 2013 at N266.3 billion, while PBT and PAT both declined 1.3% YoY to N61.5 billion and N42.5 billion respectively. Notably, the FY 14 numbers do not reflect the Q4 14 acquisition of Consolidated Breweries Ltd (CB).

- NB declared a final dividend of N3.50 per share which implies a dividend yield of 2.7% using its last trading price. Together with interim dividend of N1.25 declared in Q3 14, total payout ratio for FY 14 comes to 84% (FY 13: 79%).

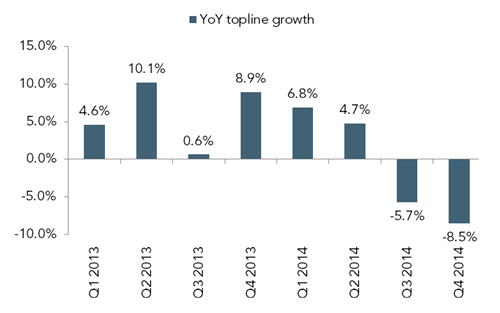

Declining premium segment volumes weigh on top-line

- Revenues contracted for the second consecutive quarter (-8.5% YoY) to N71.6 billion in contrast to our expectations for a 2% YoY expansion to N79 billion. Amid generally stable pricing, the cutback in revenues reflects sizable volume moderation and contrasts with peers Guinness Nigeria Plc (+12.8% YoY) and International Breweries Plc (+6.6% YoY) which reported volume driven growth. In its FY 14 earnings call, NB’s parent, Heineken notes that H2 14 volumes in Nigeria were driven by value beers (Goldberg and Life), implying that top-line contraction reflects slower replacement of hemorrhaging premium segment volumes (Gulder and Star) by NB’s value offerings.

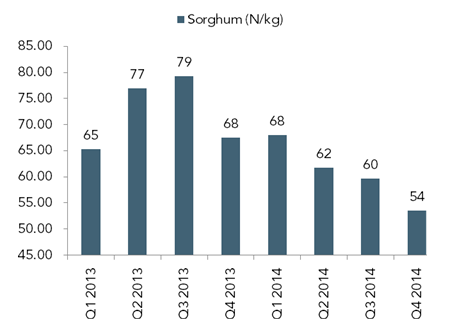

Benign commodity prices over-rides impact of evolving sales mix

- Q4 14 COGS declined faster (-9.4% YoY) than revenues to N31 billion resulting in gross profits of N40.6 billion (-7.9% YoY). Given its lower imported raw materials/COGS ratio (FY 13: ~15% by our estimates) which limits scope for sizable pass-through from USDNGN devaluation, we believe the quicker decline reflects net impact of moderation in prices of key locally sourced input—sorghum—which declined by ~21% during the reporting period using FEWSNET data. Nonetheless, the relatively modest expansion in gross margins (40bps YoY to 56.7%) suggests margin pressures from the changing product mix dampened the effect of the benign input costs. On an FY basis, COGS also tracked quicker than sales (-1% YoY) with gross margins only 10bps higher YoY at 50.9% which relative to the scale of the sorghum price moderation (-16% YoY) reflects the margin crimping impact of the higher value beer contribution to NB’s top-line.

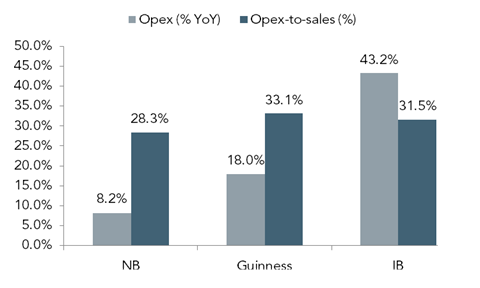

Higher S&D outlay underpins margin compression

- In line with trends across the breweries sector with Guinness (+18% YoY) and International Breweries (+43% YoY), operating expenses rose 8.2% YoY to N20.3 billion (Q3 14E: N20.4 billion) resulting in opex-sales ratio rising 4.4pps YoY to 28.3%. Despite a surge in other operating income to N532 million, Q4 14 EBIT fell 17.8% YoY to N20.9 billion with related margin shrinking 3.3pps higher YoY to 29.1% largely reflecting the higher OPEX. Similarly, opex related pressures (opex-to-sales: +60bps YoY to 26.4%) weighed on FY 14 EBIT margins (-70bps YoY to 25.1%).

- Net finance charges rose 19.6% YoY to N1.9 billion. Although no breakdowns were provided, we believe this largely reflects combined effect of moderation in cash balances (-40% YoY to N5.7 billion) and higher drawdown of NB’s credit line during the quarter (N24.7 billion) vs. N9 billion in Q4 13. The higher finance charges amplified the impact of the elevated OPEX levels on bottom-line with Q4 14 PBT and PAT declining 20.4% and 22% YoY to N18.9 billion and N12.7 billion with corresponding margins tumbling 3.9pps and 3.1pps YoY to 26.4% and 17.7% respectively.

- Overall, slowdown in revenues over H2 14 coupled with OPEX pressures underpinned the tame FY 14 reading.

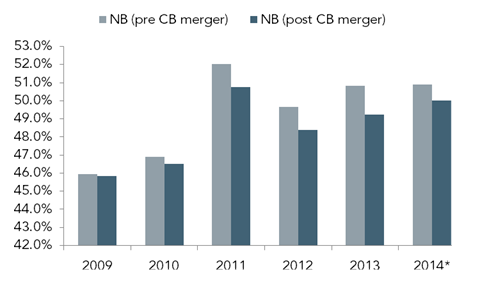

Softer earnings outlook and weaker macro-environment drives moderation in FVE

- The pullback in revenues after a strong first half suggests NB was unable to hold on to market share gains following Guinness’s price hikes of Q4 13. Outlook should be buoyed by the expanded product portfolio following the CB deal which provides NB with four value beers (33, Turbo King, Williams and More Lager) bringing segment offering to six. Though this is positive for volume growth, the resulting lower revenue per hectolitre should underpin softer sales growth. Whilst benign domestic commodity price outlook and limited exposure to currency pressures portends scope for gross margin expansion, these gains are likely to be offset by margin dilution on two fronts: via NB’s acquisition of CB and as NB’s own value brands increasingly contribute to top-line and share of premium beer shrinks.

- Furthermore, NB’s parent’s guidance to higher S&D expenses suggests that as with local peers, rising OPEX should sustain earnings pressure over 2015. Adjusting our models to incorporate the foregoing and raising our discount rate to track the rise in yields on government debt drives a moderation in FVE (which does not incorporate CB) to

N114.29 which is at an 11% discount to last trading price. NB trades at current PE of 22.9x vs. 22.7x and 38.7x for Guinness and International Breweries respectively with last trading price at an 11% discount to our FVE which implies a SELL recommendation.

Source: ARM Research