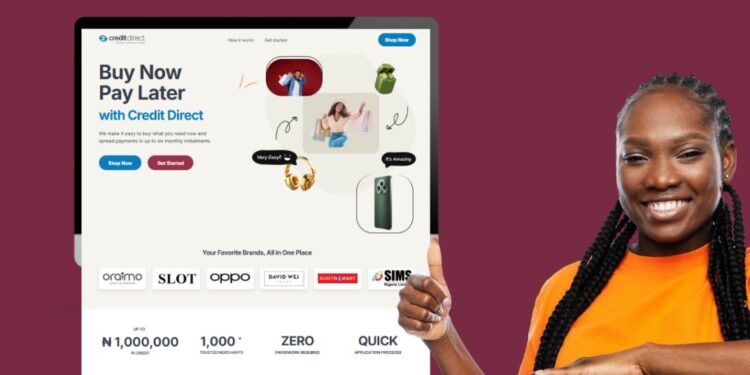

- Customers can now own the VIVO Y21d smartphone with just a 20% downpayment and repay the balance over 1 to 6 months

- Credit Direct Checkout has lowered its minimum downpayment threshold for the first time, signaling growth in Nigeria’s BNPL market

- The fully digital financing model supports smartphone access, retail sales, and national digital inclusion goals

As competition intensifies in Nigeria’s smartphone market, affordability continues to shape consumer behaviour.

The recent partnership between VIVO and Credit Direct Checkout represents a significant step toward bridging this affordability gap through structured, responsible consumer credit.

Under this new model, customers can own the latest VIVO Y21d smartphone with a 20% downpayment, while spreading the balance over a period of one to six months.

This is the first time Credit Direct Checkout has reduced its minimum downpayment threshold from 30 percent to 20 percent, marking a key milestone in Nigeria’s growing buy now pay later (BNPL) market.

A Data-Led Shift in Consumer Credit

Nigeria’s credit penetration remains relatively low, with less than 10% of adults having access to formal consumer credit. However, fintech-led solutions and embedded finance partnerships are starting to change this trajectory.

The BNPL segment is among the fastest-growing areas within Nigeria’s financial ecosystem, particularly for retail and device financing. According to McKinsey Africa’s 2024 Fintech Outlook, BNPL transactions in Nigeria are expected to grow by more than 30% annually over the next three years, driven by smartphone purchases, household electronics, and lifestyle goods.

For Credit Direct, a subsidiary of First City Monument Bank (FCMB), this partnership with VIVO aligns with its broader mission to expand digital credit access responsibly. By working directly with OEMs and retail distributors, the company is combining traditional credit risk management with technology-driven onboarding and repayment systems.

How the Partnership Works

Through Credit Direct Checkout, customers can now complete their smartphone purchase in several convenient ways — either by visiting authorized stores such as SLOT, POINTEK, FINET, or 3C HUB, or by shopping directly on a partner vendor’s website and selecting Credit Direct as the payment option at checkout.

They can choose their preferred VIVO Y21d model and pay just 20 percent upfront, with the remaining balance spread across flexible monthly installments. No collateral is required.

The financing process is fully digital. Customers shopping in-store or via official social media pages receive a secure payment link to complete their downpayment and select their repayment plan. Those buying directly from partner websites simply choose Credit Direct at checkout and complete payment instantly.

This flexible, hybrid system lowers the entry barrier for middle-income consumers who want to upgrade their devices without disrupting their cash flow. For example, a VIVO Y21d priced at N199,800 can be owned immediately with a N39,960 downpayment, while the remaining N159,840 is repaid over an agreed period.

Why This Model Matters for the Market

The partnership reflects a broader evolution in consumer credit growth across Nigeria. As more technology companies partner with licensed financial institutions, the market is shifting from informal credit practices to structured, data-backed lending.

For VIVO, the collaboration strengthens its local market presence by aligning with a credible financial partner. For Credit Direct, it deepens its positioning as a leader in ethical consumer lending and smartphone financing in Nigeria.

The model also benefits retailers, who can convert more walk-in traffic into actual sales, supported by Credit Direct’s financing infrastructure. This supply-chain integration shows how embedded finance can create shared value for manufacturers, retailers, and consumers.

The Broader Economic Implication

Access to affordable devices remains central to Nigeria’s digital economy agenda. Smartphones are the gateway to digital payments, e-commerce, and online education. By reducing the upfront cost of ownership, the VIVO × Credit Direct Checkout initiative indirectly supports national goals for digital inclusion.

If scaled effectively, such BNPL programs could also help build credit histories for first-time borrowers, gradually integrating more Nigerians into the formal financial system. This long-term effect could be transformative for consumer lending as a whole.

Conclusion

The VIVO and Credit Direct Checkout partnership represents more than a marketing campaign. It highlights how financial and technology partnerships can create new pathways for credit access and device affordability.

As Nigeria’s buy now pay later sector matures, success will depend on balancing innovation with consumer protection and responsible lending. For now, the VIVO Y21d offer signals a clear direction: smartphone ownership in Nigeria is entering a more flexible, finance-driven era.