The Lagos State Government has issued a stern warning to event organizers and venue operators against using public roads as parking or overflow spaces, citing worsening traffic congestion and risks to public safety.

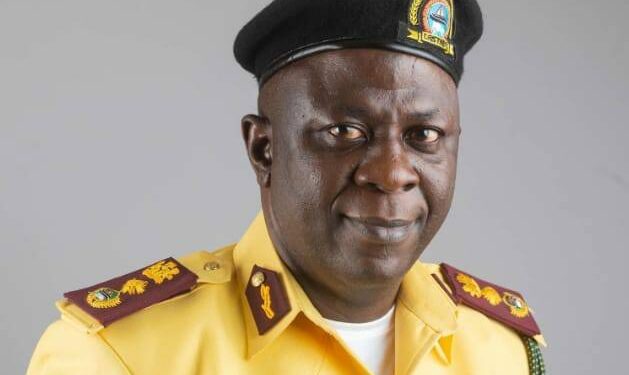

The caution, delivered Sunday by Olalekan Bakare-Oki, General Manager of the Lagos State Traffic Management Authority (LASTMA), follows a series of on‑the‑spot inspections at traffic‑prone corridors across the city.

Bakare-Oki expressed alarm at the growing trend of lavish weddings, concerts, and other gatherings spilling onto public roads, often without authorization.

The practice, he said, not only fuels gridlock but also blocks access for ambulances, fire services, and other emergency responders.

What LASTMA said

“Traffic gridlocks arising from unregulated social activities constitute an egregious affront to collective wellbeing and a needless impediment to the city’s economic momentum.

“It is both necessary and urgent to reassert, in categorical terms, that no individual, corporate body, or event organisers, regardless of stature or affiliation, has the prerogative to appropriate public roadways as ancillary extensions of their private ventures or leisure domains,” Bakare-Oki warned.

He explained that Governor Babajide Sanwo-Olu’s administration is committed to maintaining fairness and discipline on Lagos roads, adding that violators will face sanctions. Any hall, club, or social venue found guilty of encroaching on access roads, he said, will be liable for penalties and possible legal action.

The statement signals a renewed push by Lagos authorities to address the city’s chronic traffic woes, a problem that has long frustrated commuters in one of the world’s most densely populated urban areas. Major roads are often gridlocked for hours during weekends, when high-profile weddings and parties are staged, sometimes in affluent neighborhoods with limited parking infrastructure.

What we know

To strengthen enforcement, Bakare-Oki directed LASTMA units to intensify patrols and sharpen intelligence gathering, particularly during festive seasons when large gatherings are common. He also urged venue operators to act responsibly by employing certified traffic personnel or collaborating with LASTMA to develop event‑specific traffic management plans.

To bolster compliance and proactive intervention, he further encouraged members of the public to promptly report violations via the Agency’s dedicated toll-free emergency line: 0800-00-LASTMA (080000527862).

The move reflects broader concerns over the strain on Lagos’s transport system, where a mix of rapid urban growth, limited road space, and inadequate public transit has left residents vulnerable to daily traffic jams. For now, officials say the government’s priority is compliance and deterrence.