The latest data from the National Pension Commission (PenCom) reveals that Nigeria’s pension fund assets surged to N22.86 trillion as of January 31, 2025, reflecting a 1.55% increase from the N22.512 trillion recorded in December 2024.

The figures, disclosed in PenCom’s January 2025 monthly report obtained by Nairametrics, underscore the steady growth of the pension sector amid prevailing economic challenges.

Despite economic challenges, Nigeria’s pension industry continues to show stability, benefiting from strategic asset allocations and a diversified investment approach.

With continued confidence in the system, the sector is poised for further expansion, reinforcing its significance in the country’s financial ecosystem.

Portfolio allocation

A breakdown of the pension fund portfolio indicates that Federal Government of Nigeria (FGN) securities remain the dominant investment asset, accounting for N14.309 trillion or 62.59% of the total net asset value (NAV).

Other notable allocations include:

- Ordinary Shares (Local Companies) – N2.406 trillion (10.53%)

- Corporate Debt Securities – N2.267 trillion (9.92%)

- Money Market Instrument – N2.182 trillion (9.55%)

- State government securities – N248.80 billion

This diversified investment approach aims to balance risk and optimize returns for pension fund contributors.

However, money market instruments saw a marginal decline of 1.50% on a month-on-month basis, dropping from N2.215 trillion in December 2024 to N2.182 trillion in January 2025. Additionally, investments under the instrument include:

- Fixed deposit/Bank acceptance increased marginally by 1.13%

- Commercial Paper fell 13.33%

- Foreign Money Market Instruments dropped 26.07%

Meanwhile, allocations to state government securities dipped 0.82% to N248.80 billion, while supranational bonds jumped 34.09% to N27.851 billion.

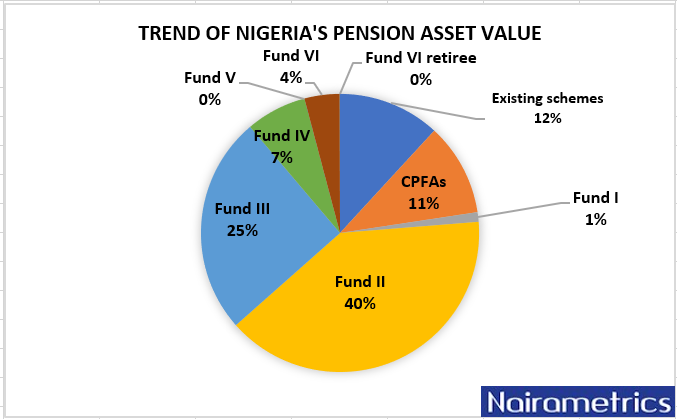

Fund allocation breakdown

Under the Multi-Fund Structure, Fund II, which is the default Retirement Savings Account (RSA) Fund, remained dominant, with N9.431 trillion or 41.26% of total NAV.

Other key fund allocations include:

- Fund III – N6.014 trillion, up 1.62% from N5.919 trillion in December 2024

- Fund IV – N1.674 trillion, marking a 3.64% increase

RSA membership also recorded a 0.31% increase, climbing from 10,582,299 in December 2024 to 10,615,028 in January 2025.

Pension fund growth

Pension fund assets, year-on-year, have jumped from N19.530 trillion in January 2024 to N22.861 trillion in January 2025, reflecting a 17.05% surge.

For context, between 2023 and 2024, pension fund assets grew by N4.156 trillion, climbing from N18.355 trillion to N22.512 trillion.

The sustained rise in pension fund assets is largely driven by increased pension contributions and a surge in portfolio values, with FGN securities alone expanding from N12.139 trillion in January 2024 to N14.309 trillion in January 2025.

This steady growth highlights the resilience of Nigeria’s pension industry, reinforcing confidence in the sector’s long-term sustainability.