FBN Holdings has approved a dividend of 40 kobo per 50 kobo ordinary share, totaling N14,358,117,116.40 (fourteen billion, three hundred fifty-eight million, one hundred seventeen thousand, one hundred sixteen naira and forty kobo), to be distributed to registered shareholders.

The approval was disclosed in a regulatory filing with the Nigerian Exchange (NGX), which outlined the key decisions made at the company’s recently concluded 12th Annual General Meeting (AGM).

As part of the resolutions passed, shareholders approved the audited financial statements for the fiscal year ending December 31, 2023, along with reports from the board of directors, auditors, appraisers, and other committees.

FBN Holdings also resolved to raise additional capital of N350 billion (three hundred and fifty billion naira) by issuing new shares through public offerings, private placements, or rights issues, targeting both domestic and international capital markets.

Providing details on the pricing strategy for this capital raise, the company explained:

“The price will be determined by way of book building or any other valuation method, or a combination of methods, in such tranches, series, or proportions and at such periods or dates, coupon or interest rates, within such maturity periods, and upon such other terms and conditions as may be determined by the Board of Directors, subject to regulatory approvals.”

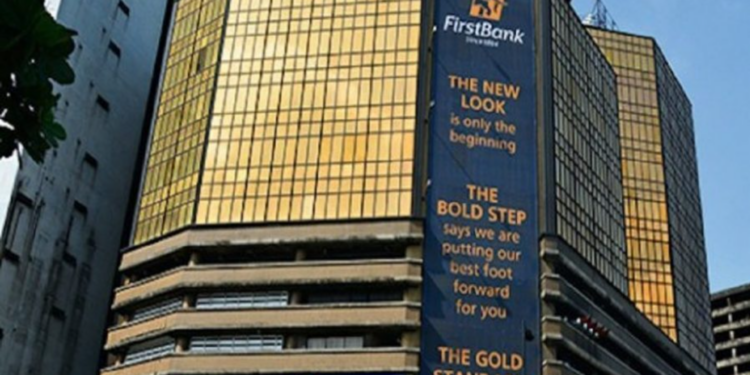

Additionally, a resolution was passed to change the company’s legal name and brand identity from FBN Holdings Plc and FBNHoldings to First Holdco Plc and First Holdco, respectively. This rebranding will also apply to all subsidiaries under the group.

Appointment and remuneration:

The Board approved the election of Dr. Abiodun Fatede and Olusegun Alebiosu as non-executive directors, alongside Kofo Dosekun, Dr. Alimi Abdul-Razaq, and Dr. Peter Aliogo as independent non-executive directors. Adebowale Oyedeji was also confirmed as the Group Managing Director.

For the statutory audit committee, Vitalis Anyalam, Hauwa Umar, and Matthew Akinlade were appointed as shareholder representatives, along with independent non-executive director Dr. Peter Aliogo and non-executive director Julius Omodayo-Owotuga.

The meeting also resolved that the directors’ fees for the financial year ending December 2024 would be set at N50,000,000 (fifty million naira) per director, with the board chairman’s fee fixed at N63,700,000 (sixty-three million, seven hundred thousand naira).

It was also stated that the remuneration and expenses of the company’s auditor, Messrs. KPMG Professional Services, would be determined by the directors for the period ending at the next annual general meeting.

Backstory

- On October 18, FBN Holdings notified the Nigerian Exchange (NGX) and the public of its plan to convene its 12th Annual General Meeting (AGM).

- The meeting agenda included both routine matters and special business, such as a proposed name change from FBN Holdings Plc and FBNHoldings to First Holdco Plc and First Holdco, respectively.

- Prior to this, the company had announced the appointment of Adebowale (Wale) Oyedeji as Group Managing Director, effective November 13, 2024.

- The appointment, which required regulatory approval from the Central Bank of Nigeria (CBN) and ratification by shareholders at the AGM, has now been finalized, despite attempts to disrupt the meeting.

- Before FBN Holdings’ 12th Annual General Meeting (AGM), a legal dispute emerged as shareholder Tohir Folorunsho Ismaila sought to block the gathering, alleging it was improperly convened.

- The case, rooted in tensions stemming from Oba Otudeko’s removal as chairman by the CBN, was widely seen as a direct challenge to the current leadership of FBN Holdings.

- However, on September 12, 2024, the Federal High Court in Lagos dismissed Ismaila’s petition, upholding the AGM’s legality and affirming the authority of the board.