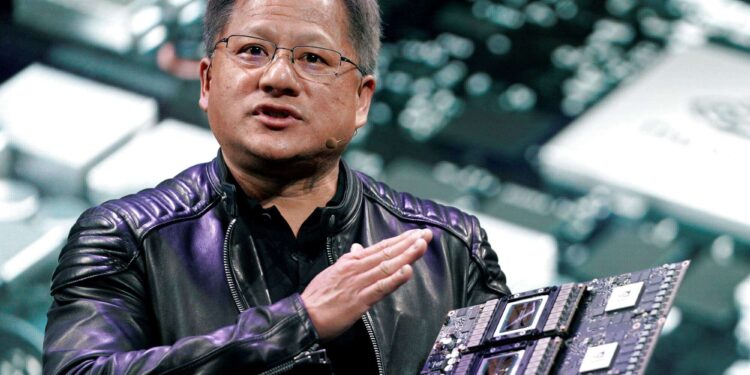

Nvidia CEO Jensen Huang described demand for the company’s AI chips as “insane” during a televised interview with CNBC on Wednesday, showing the rising interest in artificial intelligence technology.

Huang’s comments coincided with the announcement of an expanded partnership between Nvidia and IT consulting giant Accenture, aimed at helping companies deploy AI solutions at scale.

The collaboration with Accenture will see the creation of a new business group dedicated to assisting clients in building custom AI systems using Nvidia’s cutting-edge technology. The partnership also incorporates Meta’s Llama, a collection of open-source AI models, reflecting Nvidia’s broader strategy of aligning with key players in the AI ecosystem to meet growing global demand.

“This partnership allows us to address a significant portion of the world’s AI demand,” Huang said. “It marks the beginning of a new wave we call enterprise AI.” The deal with Accenture is intended to help businesses harness AI technology to improve operations, drive innovation, and remain competitive in an increasingly AI-driven landscape.

What to know

The surge in demand for Nvidia’s AI chips has propelled the company’s stock to remarkable heights. Nvidia shares closed 1.6% higher on Wednesday and have more than doubled in value since the start of the year.

As corporations rush to build out their AI infrastructure, Nvidia has emerged as the dominant provider of AI hardware, particularly its graphics processing units (GPUs), which are essential for AI applications. Meanwhile, Accenture shares rose 1.2% on the same day, continuing a modest upward trajectory with a 1.5% gain year-to-date.

Nvidia’s growth has been buoyed by the rapid adoption of AI technologies across industries. From autonomous vehicles and healthcare to cloud computing and finance, businesses are increasingly turning to AI to enhance productivity and deliver new capabilities. Nvidia’s chips, designed to process complex AI workloads, have become the go-to choice for companies looking to develop AI-powered solutions, from machine learning to natural language processing.

By creating an extensive network of partnerships, Nvidia aims to solidify its market leadership and ensure its chips remain integral to the development of next-generation AI technologies.

The partnership with Accenture is another step in Nvidia’s broader strategy to expand its footprint in the enterprise AI market, which is expected to grow exponentially in the coming years. As Huang noted, this collaboration is just the beginning of a new era in which AI becomes a core component of corporate strategy, transforming industries and reshaping how businesses operate globally.