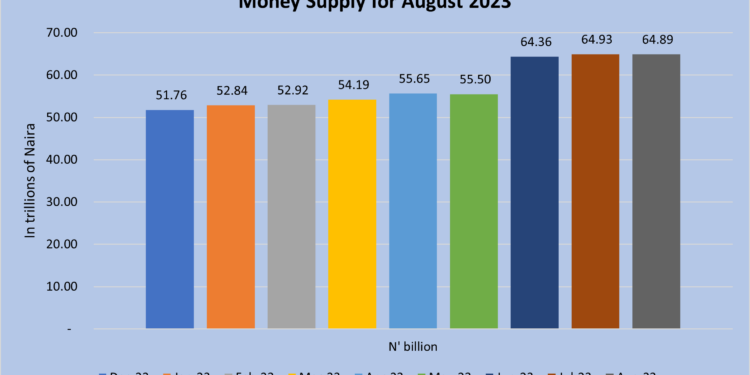

Nigeria’s money supply declined to N64.8 trillion in the month of August 2023, a marginal drop from N64.9 trillion in July 2023.

This compares to the N64.3 trillion in June and N55.5 trillion recorded in May 2023.

These figures come from the latest data released by the Central Bank of Nigeria as captured in its money and credit statistics.

The money supply, identified as M2, captures the total amount of money available in the economy at a particular moment.

This includes physical currency such as coins and banknotes, in addition to various types of deposits maintained by individuals, enterprises, and institutions in banks and other financial entities.

Why this matters: The money supply is a crucial indicator when evaluating interest rates and potential inflation during a certain timeframe.

- The recent surge in Nigeria’s money supply aligns with challenges like escalating inflation, pressure on the exchange rate, and diminishing interest rates.

- As the money supply grows, there’s a rising chance of inflation, leading to decreased purchasing power.

- Additionally, a larger money supply might result in declining interest rates, especially when investment assets are in short supply.

- This could potentially make Nigerian assets less enticing to overseas investors, a concern given Nigeria’s dependence on dollar imports.

Key Highlights of the Data

M2 Breakdown – A closer look at the data reveals that certain components of the money supply, namely demand deposits, quasi-money, and currency outside banks, also witnessed growth and declines.

- Specifically, quasi-money, which pertains to financial tools that can be easily converted to cash, surged from N101.1 billion to N40.8 billion in the month of August 2023.

- Moreover, demand deposits, primarily made up of chequing accounts or funds in banks accessible without prior notice, fell by N221.1 billion to N21.7 trillion.

- In contrast, currency outside banks observed a relatively modest increment of N86 billion to N2.29 trillion.

Other data – Apart from M2 components, another money supply measure known as M3, declined by N20.9 billion to N65.4 trillion.

- Net foreign assets continued its decline to N7.1 trillion in August from N9.2 trillion the month earlier.

- Notably, credit to the government expanded from N32.3 trillion to N32.5 trillion, and net domestic credit climbed from N86.4 trillion to N87.2 trillion.