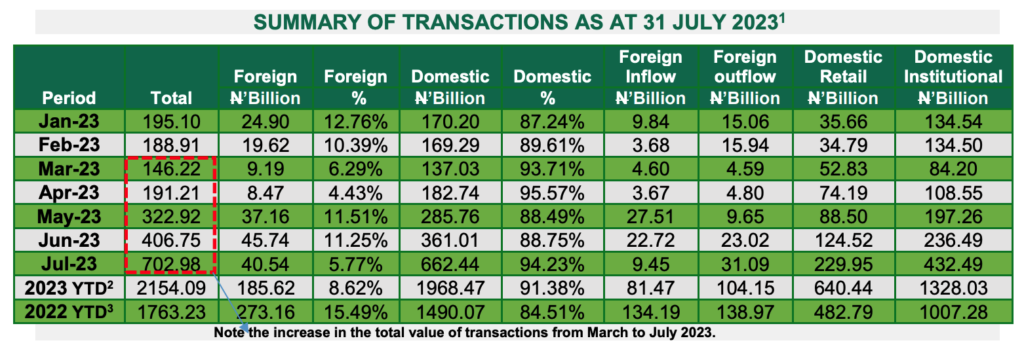

Total transactions in Nigeria’s equities market surged to N702.9 billion in July 2023, representing a 72.83% surge when compared to the N406.75 billion recorded a month earlier.

This is according to the Domestic and Foreign Portfolio participation in equity trading published by the NGX.

When compared to July 2022 where the total transaction was just N101.1 billion, the equities market has seen a whopping 594.78% increase year on year.

The surge in transactions in the equities market reflects the bullish sentiments demonstrated by investors after the government announced the withdrawal of fuel subsidies and the unification of the exchange rate.

Domestic Transactions Lead the Way

A testament to rising confidence in local markets, domestic investors in Nigeria have significantly overshadowed foreign investors, making up an impressive 88% of total market transactions.

- This remarkable turnout from domestic investors can, in part, be attributed to recent governmental policy changes.

- The decision to withdraw fuel subsidies and unify the exchange rate appears to have galvanized domestic investment, rejuvenating interest and participation in the Nigerian equities market.

- Month-over-Month Growth: When comparing the data on a month-over-month basis, domestic transactions surged by a notable 83.50%, leaping from N361.01 billion in June to N662.44 billion in July.

- This uptick suggests that local confidence in the market is not merely a fleeting sentiment but rather a sustained trend.

But Foreign Investment Wanes: Contrary to the enthusiasm shown by domestic investors, foreign transactions exhibited a slight decrease, falling by 11.37% from N45.74 billion (approximately $60.49 million) in June to N40.54 billion (approximately $52.58 million) in July.

- This dip suggests that efforts may be needed to bolster international confidence in the Nigerian equities market.

Institutional vs. Retail Investors: Within the pool of domestic transactions, institutional investors have taken the lead, outperforming retail investors by a 30% margin.

- Retail transactions weren’t left far behind, experiencing a significant 84.67% growth from N124.52 billion in June to N229.95 billion in July.

- Institutional transactions also saw robust growth, increasing by 82.88% from N236.49 billion in June to N432.49 billion in July.

What This Means

Nigeria’s equities market has experienced a significant surge in returns since the Tinubu administration took office.

- Dubbed the “TinuBull” by Nairametrics, the market has been on an upward trajectory, with stocks posting consecutive positive returns: gains of 6.42% in May, 9.32% in June, and 5.53% in July.

- On a year-to-date basis, the Nigerian All Share Index has risen by 25.53%, showcasing the market’s robust health and growing investor confidence.

- The data further indicates a substantial shift in investor behaviour, with local participants increasingly bullish on Nigerian equities.

- This surge in domestic investment can be interpreted as a vote of confidence in the government’s policies, particularly as it comes in the wake of significant economic changes such as the withdrawal of fuel subsidies and the unification of exchange rates.

However, the decline in foreign investment serves as a cautionary note, signaling the need for a more diversified investment base to ensure long-term market stability.

Nairametrics analysts suggest that the subdued participation of foreign portfolio investors is likely reflective of broader concerns about the state of the Nigerian economy.

While the “TinuBull” market signifies a positive momentum, ensuring its sustainability will likely require targeted policy measures aimed at alleviating foreign investor concerns and fostering a more balanced, stable investment environment.