The exchange rate between the naira and dollar closed in the month of July at N756.94/$1 representing a 1.6% gain from the N769.25 it closed in the month of June.

This is according to end-of-month data from the FMDQ which also showed that the market opened at N784.91/$1 before gaining to close at N769.25.

The intra-day high rate of N830/$1 and an intra-day low of N651/$1 while the daily turnover was $67 million. Total market turnover during the month was $1.69 billion.

Rate volatility: The exchange rate has been a volatile month long as demand pressure persists among a supply gap across markets.

- During the month under review, the exchange rate registered a year-to-date low closing rate of N803.90/$1 as demand continues to outstrip supply.

- Intra-day exchange rate high hit the lowest level of N869/$1 on the 27th of July 2023.

- The naira traded at its strongest on the 26th of July when it closed at N740/$1.

- Meanwhile, NAFEX rates also closed at an average of N770.89 as of July 30th, 2023.

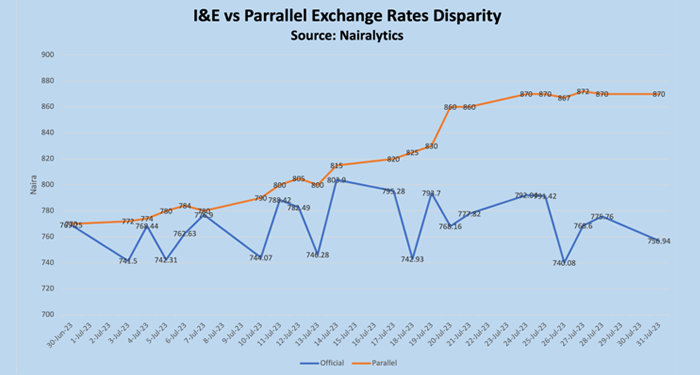

Parallel Market: On the parallel market, quotes from forex traders indicate the exchange rate was quoted at an average of N870/$1 after opening the month at N770/$1.

- The peer 2 peer market was also quoting at about N869/$1.

- This represents a month-to-date depreciation of 11.49% by far the worst depreciation this year.

- The British Pound also crossed N1,000/£1 for the first time, closing at N1,165/£1 after opening at N995/£1.

- The disparity between the official and parallel market rates has now widened to about N110/$1 after achieving an initial convergence.

Central Bank’s stance on forex volatility

In the recent monetary policy committee meeting, Acting Governor Fola Shonubi of the Central Bank acknowledged that the ongoing forex volatility can be primarily attributed to the limited supply of foreign currency.

- He expressed optimism that addressing the supply issues would likely lead to a reduction in volatility.

- To attract dollar inflows, government officials have been engaging in consultations with foreign investors, as reported by Nairametrics last week.

Meanwhile, Bureau De Change (BDC) operators have been excluded from the official forex market since Godwin Emefiele ceased selling dollars to them last year.

- Some BDC operators argue that their absence from the market contributes to the volatility in the parallel market because the lack of supply puts immense pressure on their ability to meet the high demand.

- They also urged the Central Bank to reconsider their exclusion and reintegrate them into the formal forex market.

In a speech to Nigerians, President Tinubu stated that his team was “monitoring the effects of the exchange rate and inflation on gasoline prices” and that intervention was on the cards ie necessary.

- “We are also monitoring the effects of the exchange rate and inflation on gasoline prices. If and when necessary, we will intervene.”