Key highlights

- The naira rose to its highest level against the dollar since December 2022 on Wednesday as demand for the dollar-backed stablecoin declined on Binance’s P2P market.

- The Nigerian Foreign Exchange (Nafex) marketplace sets the exchange rate between the naira and the dollar in Nigeria, with the spot market rate at N465 to $1.

- The Central Bank of Nigeria (CBN) has demonstrated a favourable stance towards stablecoins, with an 83-page CBN research report highlighting that a legal framework must be created for the potential adoption of a stablecoin in Nigeria.

The naira rose to its highest level against the dollar since December 2022 on Wednesday as demands for the dollar-backed stablecoin declined on Binance’s P2P market.

Nairametrics observed as the local currency was initially trading at N701 per dollar during the intraday trading session before moderating to N729/$ at the time of filing this report.

The naira lost some of its gains on the P2P market after traders weighed on comments by US Treasury Secretary Janet Yellen that the US economy was doing extraordinarily well. Interestingly, some Fed executives seem to disagree with one another over likely future rate increases from the bank.

In the meantime, the US inflation rate report is expected later today. It will be extensively scrutinized for clearer indications of the Fed’s rate path. Ahead of the upcoming Federal Open Market Committee (FOMC) meeting in early May, the interest rate markets are pricing a better-than-even likelihood of an increase to the target cash rate.

What you should know

The official exchange rate, which rules the others, is strictly controlled by the Central Bank of Nigeria (CBN). The Nafex, a marketplace for exporters and importers, is also responsible for setting the exchange rate between the naira and the dollar in Nigeria.

The Nigerian Foreign Exchange (Nafex) was established in 2017 following Nigeria’s 2016 economic crisis. In the spot market, the naira to the dollar exchange rate is N465 to $1.

Dollar-based stablecoins have become a desirable alternative for customers and businesses in regions with unstable local currencies.

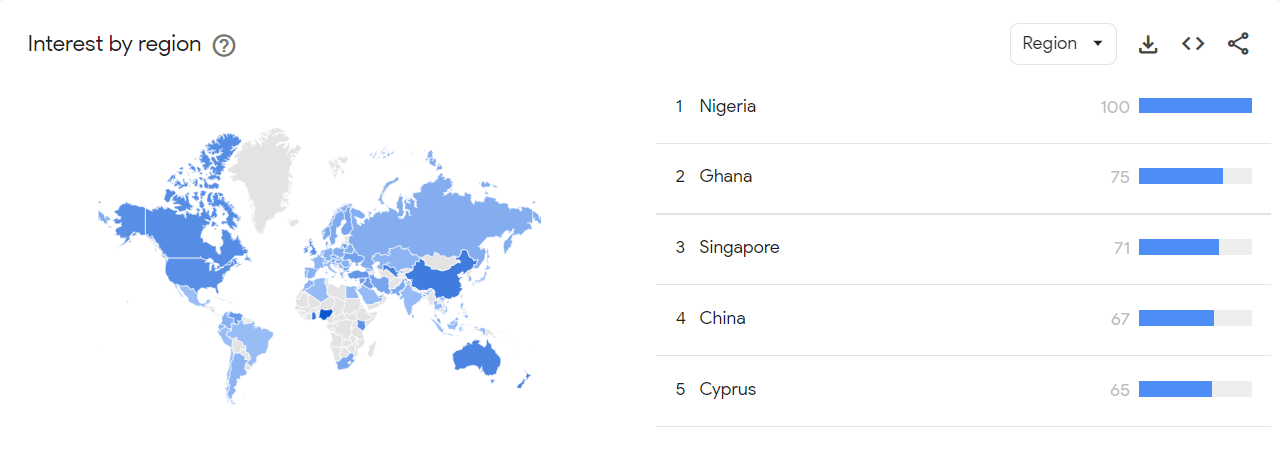

Nigeria also has the highest interest in Tether based on Google trends data with a perfect score, further emphasizing the high level of interest and recognition of the digital currency in the country.

The CBN’s stance on stablecoins

Recently, the Central Bank of Nigeria has demonstrated a favourable stance regarding stablecoins. The construction of a legal framework for the potential adoption of a stablecoin in Nigeria was studied in an 83-page CBN research report that was recently published by the central bank under the title “Nigeria Payments System Vision 2025.”

The apex bank’s report highlighted that stablecoin-based payment systems would probably succeed in the country; hence a framework must be created. In 2021, the CBN took a tough stance toward the digital industry, virtually forbidding Nigerian banks from providing banking services to cryptocurrency exchanges.

According to Mr Paolo Ardoino, the Chief Technology Officer (CTO) at Tether, the token has significantly aided in the development of a more interconnected ecosystem because it combines the advantages of both traditional and digital currencies, such as price stability and instantaneous global transactions.

The Tether CTO added that stablecoins have made it easier for migrant workers to overcome the costly and restrictive barriers surrounding the remittance infrastructure. He said:

- “Stablecoins have discovered major use cases for remittances sent across international borders by migrant workers. To send money back to their families and loved ones, many workers currently must use companies like Western Union. Families lose a significant portion of their finances due to the lengthy and expensive nature of this process.”

Whatever happened to parallel market rate you guys used to include in previous publications? Seems the authorities have gotten to you lot too. smh

I came here looking for that too. I actually bookmarked their “Currencies” page because of their daily parallel exchange rate updates but now it seems Nigeria has caught up with them too.