We know that with rising inflation locally and globally, the cost of living is biting hard. While Nigeria’s inflation has been reported by the NBS at 20.77% in October, it can mostly feel much, much higher when we undertake our periodic and regular transactions – food, transport, services, etc.

Hence it came as no surprise to some when Steve H. Hanke, a Professor of Applied Economics at Johns Hopkins University, claimed that Nigeria’s inflation rate is 52 percent.

With all that, we know your finances are important, your income is important, investments are important, and savings are important too. As such, despite the challenges out there, we still recommend that where you can save, even if at a reduced rate than during boom times, try to save. Tough times never last forever; as we know, after night comes the day.

Money Market Mutual Funds: One regulated vehicle that can be used for this purpose is money market funds. Money Market Funds are products created by asset management firms. They are registered, and regulated by the Securities & Exchange Commission and managed by professional fund managers employed by the asset management firm, which itself is regulated by SEC.

- Money Market Funds are low-risk savings products that invest in money market instruments such as treasury bills, commercial papers, bank deposits, etc. The funds are highly regulated to ensure that they are low risk, maintain a stable value and hence preserve capital and have low volatility.

- As such, with current regulations, no instrument in a fund should have a maturity of more than 364 days, and the fund should have an average maturity of no more than 90 days. These funds generally provide a higher return than interest-bearing savings accounts and can be used for short-, medium- and long-term savings. Money Market Funds are currently the largest pool of mutual funds with assets under management of N577.84bn, 39.08% of all mutual funds.

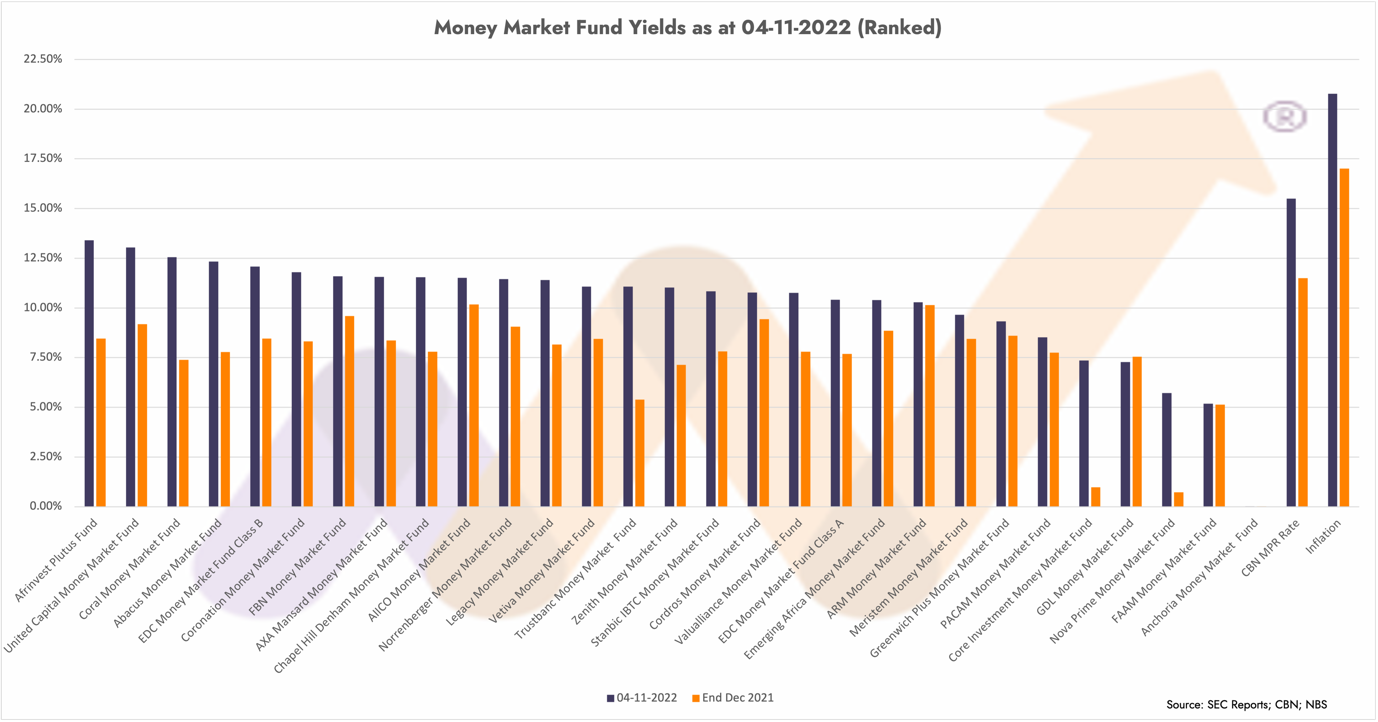

Currently, you have 29 different money market funds to choose from. Some have set their starting investment level as low as N1,000 – N2,000. As of 4 November 2022, every single money market fund bar one yielded higher than the upward reviewed 4.20% interest rate the CBN instructed banks to adjust the savings deposit rate to on 1 August 2022.

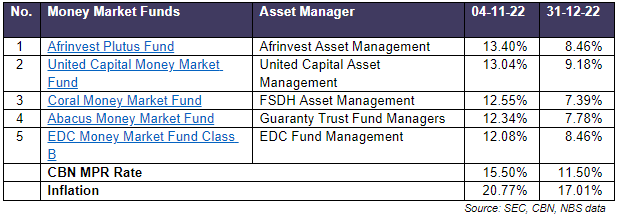

From current data available from SEC, a summary review of yields on money market funds for the week ending 4 November 2022 show the top-yielding funds as follows:

All fund rankings for the period are as follows:

Selecting a Money Market Mutual Fund: We say it again, start with information! Information!! Information!!! Ask for and get Information. Why would you give your money to a manager to invest for you who is a scrooge with the information you need? Do your research. Request for and read the brochures, fund accounts, fund factsheets, etc.

- All mutual fund managers are required by SEC rules to publish their fund’s daily prices on their website (some do, most do not) but then you might not have the time nor patience, or data to go through all 29 websites, so just use one – check out the money market section of the moneycounsellors.com website here.

- Whilst yields on money market funds have climbed so far in 2022, with the steep rises reported in inflation and the interest rate rises by the CBN, money market funds still have a bit of catching up to do to ensure investors are not left poorer because of inflation. Nevertheless, the yields on offer and the trends of weekly rises (please click here for historical charts) offer a better return than traditional savings accounts in banks.

Mutual funds are a good way of investing and saving your money. You get professionals and specialists hired by the asset management firm, whose job it is to invest your and thousands of other people’s money, which has been pooled together to form the fund and invested according to the investment objectives of the fund in question.

- However, do not just go by the ranking above because a fund on top could be dethroned tomorrow. Focus on the historical antecedent of the fund, its fund managers, asset allocation, the consistency of performance, and the release and presentation of information amongst other things. And by the way, this applies to your pension fund as well.

For information, data and analysis, performance, and rankings of all mutual and pension funds in Nigeria go here.

This is good news but I need an in depth knowledge to go about it thanks

Interesting to note this

l wish to thank the author for this write up.

ln March 2022, l invested in Money Market (Legacy Money Market), then l could view the daily market prices, sometime in August the same year, l observed they did website update and since then l am unable to view the daily prices as l ought to, l have sent several mails to them over the issue and up till date nothing has been done about it as l am being kept in the dark over the daily tradings. l intend to pull out my funds by January next year if nothing is being done about, but my only problem is which money market organization shows their daily prices so l can move and monitor my funds. Please, your candid advice will be highly appreciated, thank you.

ARM display theirs, I am currently using ARM