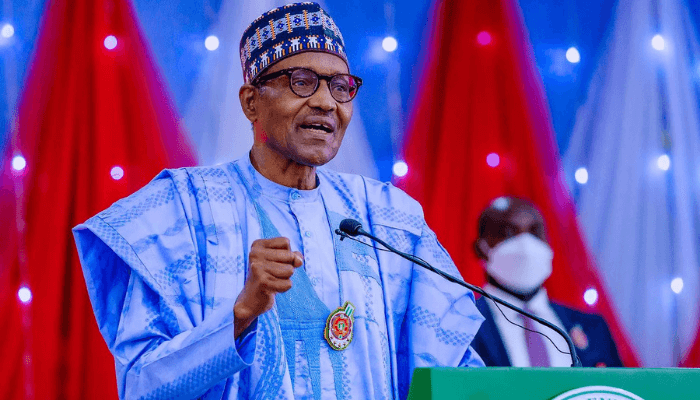

Nigeria launching the Startup Bill is the latest buzz that has brought excitement to many, including startup founders, employees, and graduates. On October 19, 2022, President Muhammadu Buhari officially signed the Startup Bill into law, creating the Startup Act 2022. The Nigeria Startup Bill (NSB) project is a collaboration between the Nigerian tech sector and the presidency with the goal of utilizing jointly developed rules to fully realize the potential of its digital economy. There is some relief in the industry as a result of this initiative to promote startups and rising digital businesses in Nigeria because there has been a need for a legal framework governing startup operations. The Startup Bill is intended to control how startups operate and to support businesses with investments and tax benefits.

A startup is a business that is just starting out and is frequently financed in its early stages by its intrepid founders. There has been a notable increase in the formation of startups during the past several years, particularly in Nigeria. Many of them operate in tech-related industries, including edtech, finance, insurtech, logistics, agriculture, and health. As of September 2022, over 481 startups were operating in Nigeria, and 383 of those raised more than $2 billion in just seven years.

The Startup Bill roadmap

Starting May 2021, the Startup Bill had been in process for over 17 months with its first draft published in June 2021. Decision makers of the presidency and the ecosystem reviewed the draft designing its components in July 2021. From August through September 2021, meetings for deliberations and validations were held until the final draft was released. From the latter part of 2021 to mid-2022, the Bill was submitted to the National Assembly where it was read and passed into law, then signed in October 2022.

NSB influencing digital businesses

It is anticipated that Nigeria Startup Bill (NSB) will significantly improve the business environment for startups in Nigeria, fostering their success. The bill makes provisions for tax and fiscal incentives, training and capacity building, startup labeling, accelerators and incubators, regulation support, etc. This note focuses on the Act’s degree of impact by implementation on digital businesses as explained below.

Business licensing and certification

With its enticing incentives for participating in the startup ecosystem, the Nigerian Startup Bill (NSB) appears to be promising. As a result, a large number of digital businesses would need to certify in order to benefit from the bill. To be eligible under the Act, the business must be a labeled startup operating for no more than ten years and registered as a limited liability company under the Companies and Allied Matters Act 2020.

Only a few businesses that have propelled the growth of startups in Nigeria are older than ten years as limited liability companies under the provisions of the bill. Viably, this appears to be unfavorable to both emerging and recent (less than ten years old) digital businesses.

Employee cap

According to the bill, a labeled startup is required to employ at least ten workers. A startup is a company that is in its infancy, which is sometimes referred to as the difficult years before stability. As the nation’s economy has rapidly declined, fewer digital businesses have had up to ten long-term employees over the years because so many people are employed seasonally or under contract due to their lack of expertise

or cheap pay.

Incompetence and output

Tax relief for new businesses sounds relieving and like a long-overdue chance to use those fractions to support business growth. Many people would like to avoid paying taxes if they could. It is encouraging to see NSB introduce tax breaks, which are deductions or tax exclusions that lessen a business tax burden. Except because of this clause, the labeled startup employee cap should be made up of 60% of people who graduated within the previous three years and have no prior work experience.

The expansion of digital businesses will be hampered by this, which at first glance appears to be battling unemployment. Evidently, production suffers when there are too many unqualified workers around – this is unhealthy for startups. Given tax relief is only available for a maximum of five years, startups would prefer to hire skilled workers and pay taxes while being productive rather than sacrifice their growth.

Conclusion

The objective of the presidency and NSB to promote a well-organized startup ecosystem and labeling process in Nigeria is commendable, but unrealistic parts of the law should be evaluated and changed accordingly for a more supportive environment. If otherwise, startups might be dissuaded from operating in Nigeria, leaving the sector to only optimism that it will adjust naturally in the future.

.gif)